eResearch| Earlier this month Uber (NYSE: UBER) announced an agreement to acquire alcohol delivery application Drizly for $1.1 billion.

Along with Uber’s $2.65 billion acquisition of Postmates mid-2020, this purchase highlights the increasing consolidation of delivery platforms.

Benefits of consolidation are:

- Economies of scale – distributing software development costs over more revenue.

- The network effect – where users, drivers, restaurants, and retailers get more value with increased platform participation.

Drizly’s healthy valuation stems in part from changing consumer behaviour from the pandemic – stay-at-home orders and public health policies have prompted consumers to shop online.

Ecommerce

The pandemic has changed how we shop.

Perhaps working from home and receiving packages during working hours decreases porch piracy concerns or maybe consumers find it is a better use of time to skip the store. Retailers also see advantages to distributing online, such as lower inventory costs, fewer returns, and cheaper real estate.

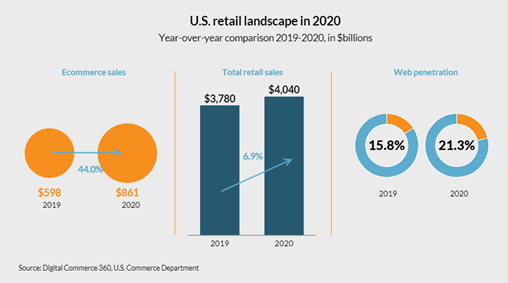

Whatever the case, more purchases happened online last year. Digital Commerce 360 reported a 44% sales jump in 2020!

Amazon (NASDAQ: AMZN) recorded $125 billion in revenue in Q4 and PayPal (NASDAQ: PYPL) saw its valuation surpass Mastercard (NYSE: MA).

Shopify (TSX: SHO |NYSE: SHOP), which provides retailers with eCommerce software, overtook the Royal Bank of Canada (TSX: RY |NYSE: RY) as the most valuable Canadian company in May 2020 and has increased its market capitalization by 43% as of February 19, 2021.

Drizly

Headquarter in Boston, Massachusetts, Drizly is an alcohol marketplace and delivery service founded in 2012. It currently operates in many major US cities and select Canadian cities.

The application is simple: download, open, browse, and buy. Within 60 minutes, your order is at your door. Drizly offers a wide selection. From local craft brews or national brands. All without running out to the store.

Drizly partners with local liquor dealers, brewers, and vintners similar to other food delivery applications.

Drizly raised $119.6 million over nine funding rounds, according to Crunchbase, giving early investors a healthy return.

Uber

Uber is predominately known as a ride-sharing application, connecting drivers with passengers. It also operates delivery services, connecting people with goods.

At first glance, Uber appears to be in a worse position now compared to last year. Book equity is down 35% from $14.8 billion to $9.63 billion, and revenue in the first nine months decreased 12% from $10.1 billion in 2019 to $8.91 billion in 2020.

So why was Uber up 36% from in 2020?

Because the revenue composition has been dramatically affected by the COVID-19 pandemic. Compared to 2019, revenue in the third quarter from mobility was down 53% while delivery was up 125%.

The market seems to think that mobility revenues will come roaring back as restrictions lift and that the delivery revenue boost will stick around.

Uber also slashed its R&D expenses in 2020 by more than $2.5 billion (59%) over the same nine-month period in 2019, hinting at a maturing company.

Unfortunately for Uber, legal battles in the U.K. and California have threatened its business model. These jurisdictions have opted to classify drivers as employees rather than contractors, possibly increasing operating costs for Uber.

Competing applications such as Grubhub (NYSE: GRUB) and DoorDash (NYSE: DASH) also made headlines in 2020.

The questions for investors to ask: what will the post-pandemic world look like, what will go back, and what changes will stick around in 2021?

Uber closed the week at $58.39 with a Market Cap of $98.2 billion.