eResearch is pleased to publish an updated Equity Research Report on Organic Garage Ltd. (TSXV:OG | FSE:9CW1) pertaining to OG’s recent release of its FQ3/2021 financial statements.

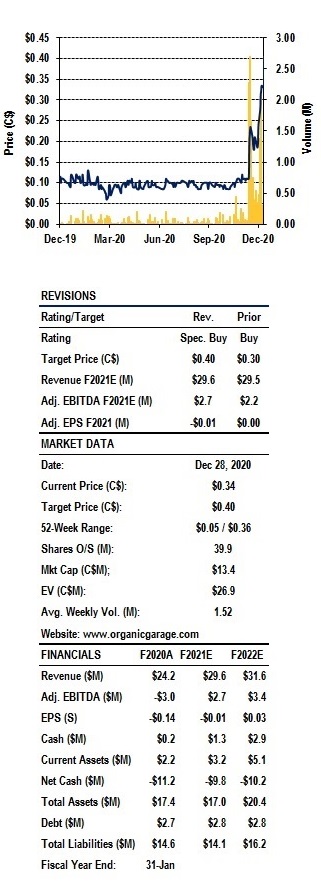

We are increasing our one-year target price to $0.40 from $0.30 and changing the rating to Speculative Buy from Buy.

You can download our 13-page Update Report by clicking on the following link: eR-OG-UR-2020-12-29-FINAL

//

Organic Garage is an independent, Canadian chain of organic and natural product grocery stores that operate in Toronto and the Greater Toronto Area in southern Ontario, Canada. The Company focuses on providing customers with healthy choices at a low cost. Its ability to efficiently source organic products allows it to pass along the savings to customers. Its store concept checks multiple boxes with today’s food customers: healthy food, good value, small store convenience, and an overall premium shopping experience.

Organic Garage is an independent, Canadian chain of organic and natural product grocery stores that operate in Toronto and the Greater Toronto Area in southern Ontario, Canada. The Company focuses on providing customers with healthy choices at a low cost. Its ability to efficiently source organic products allows it to pass along the savings to customers. Its store concept checks multiple boxes with today’s food customers: healthy food, good value, small store convenience, and an overall premium shopping experience.

QUARTERLY HIGHLIGHTS:

- Sales continue to register a stay-at-home bump. FQ3/2021 revenue was $6.92 million, an increase of 21.6% year-over-year. Organic Garage continues to show strong growth during the current health crisis and recognized revenue increases in FQ1/2021 and FQ2/2021 of 19% and 29% year-over-year, respectively. We believe this sales trend should continue for most of C2021.

- Online sales jumped over 40%. Online sales increased to 8.5% of total sales in the quarter versus 6.0% in the previous quarter. Online sales continue to grow to meet the demand brought about by stay-at-home shoppers looking for home delivery. We believe that online sales should continue to increase.

- Gross Profits remains steady above 30%. Gross Profit increased to 30.4% from 25.7% in the same quarter last year and similar to the previous quarter of 30.6%.

- Previous cost-cutting measures improve EBITDA. As a percentage of sales, Operating Expenses decreased to 31.0% during the quarter from 37.4% in the same quarter last year. Cost reductions implemented during F2020 continued to help with margins. In FQ3/2021, EBITDA was substantially higher at $0.69 million compared to $0.05 million in FQ3/2020.

- The New Leaside store should increase revenue in C2021 and beyond. The Company’s fifth store, slated to open in the first half of 2021, should boost revenue by 10-20% in F2022 and 15-25% in F2023.

FINANCIAL ANALYSIS & VALUATION:

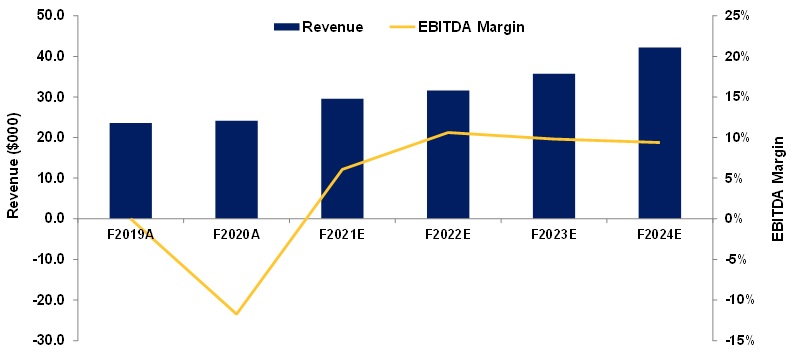

- We estimated Organic Garage’s financials as:

- F2021E: Revenue $29.6 million; Adj. EBITDA $2.7 million;

- F2022E: Revenue $31.6 million; Adj. EBITDA $3.4 million.

- Due to the stock price re-rating, we have increased the revenue multiple to 0.8x from 0.6x.

- We calculated an equal-weighted price per share of $0.41 from a multiple of 0.8x, the one-year forward Revenue of $30.3 million, a multiple of 9.0x the one-year forward EBITDA of $3.0 million, and a DCF from a multiple of 9.0x the five-year forward terminal EBITDA of $4.2 million at a 10% discount rate.

We are increasing our one-year price target to $0.40 from $0.30 and revising our rating to a Speculative Buy from Buy.

//

You can download our 13-page Update Report by clicking on the following link: eR-OG-UR-2020-12-29-FINAL

//

CHART 1: Revenue and EBITDA Margins