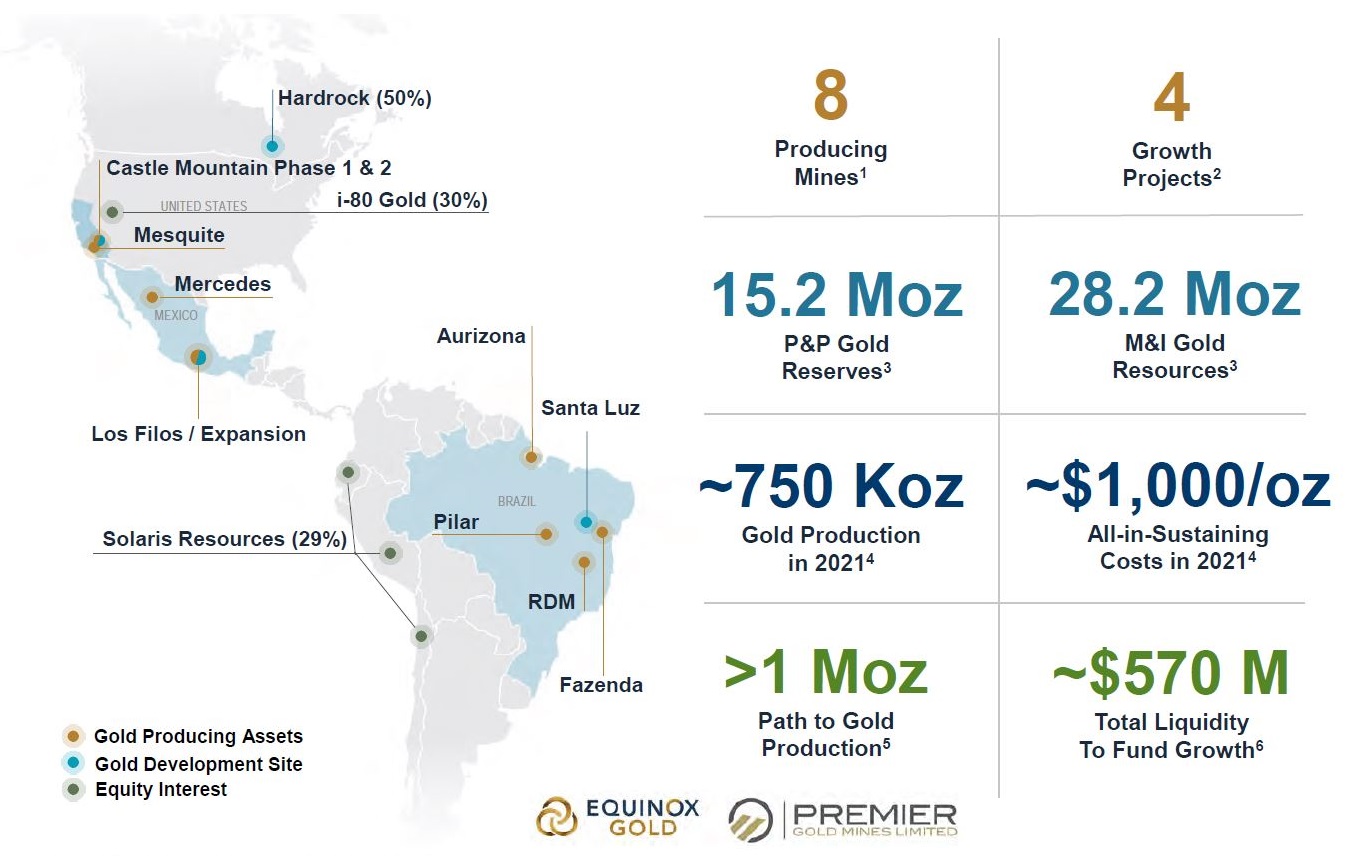

eResearch | Equinox Gold Corp. (TSX:EQX | NYSE:EQX) and Premier Gold Mines (TSX:PG, OTC:PIRGF) announced that the companies have entered into an agreement whereby Equinox Gold will acquire all of the outstanding shares of Premier Gold and concurrently, Premier Gold will spin-out its Nevada-based assets into a new company to be called i-80 Gold Corp.

Equinox Gold will obtain Premier Gold’s 50% interest in the Hardrock Project in Ontario, the Mercedes Mine in Mexico, and the Hasaga and Rahill-Bonanza properties in Red Lake, Ontario.

The Hardrock Project is a fully-permitted, development-ready, 5.5 million gold ounce project in Ontario that grades at 1.27 grams per tonne. The Hardrock Feasibility Study indicates a 14-year mine life with an average annual production of 358,000 gold ounces.

After the transaction closes, existing Equinox Gold and Premier Gold shareholders will own approximately 84% and 16% of Equinox Gold, respectively.

Transaction Value

Premier Gold shareholders will receive 0.1967 of an Equinox Gold share and 0.4 of a share of an i-80 Gold for each Premier Gold share held.

With 2.98 million ounces of gold reserves and 10.12 million ounces of gold resources attributable to Premier Gold, the C$607 million deal values the transaction at over US$200 per reserve ounce and almost US$60 per resource ounce.

New i-80 Gold Spin Out

i-80 Gold will own the South-Arturo and McCoy-Cove properties, and include Premier Gold’s previously announced acquisition of the Getchell Project from Waterton Global Resource Management, Inc.

Equinox Gold and existing shareholders of Premier Gold will own 30% and 70% of i-80 Gold, respectively.

Transaction Rationale

The transaction immediately grows Equinox Gold’s annual production by 50,000 gold ounces per year from the Mercedes Mine in Sonora, Mexico, in addition to its estimated 700,000 gold ounces of production from existing mines in 2021.

Equinox Gold also believes that this transaction will bolster its pipeline of projects and will add 200,000 attributable ounces of long-term, low-cost annual gold production, in a safe, North American jurisdiction.

Concurrent Financing to Fund Equinox Gold and i-80 Gold

To fund the transaction, Equinox Gold will complete a C$75 million equity financing fully underwritten by its Chairman, Ross Beaty.

As part of the spin-out, i-80 Gold’s initial working capital will include approximately $15 million in cash. In connection with a planned public listing for i-80 Gold, it intends to conduct a C$75 million financing and Equinox Gold has committed to subscribe to 30% of the financing, up to a maximum of C$22.5 million.

After the customary regulatory, court, stock exchange, and other approvals, the transaction is expected to close in the first quarter of 2021.

DIAGRAM 1: Equinox Gold + Premier Gold