eResearch | Toronto-based Yamana Gold Inc. (TSX:YRI | NYSE:AUY | DB:RNY) plans to buy Monarch Gold Corporation (TSX:MQR | OTC:MRQRF) in a cash and stock deal worth approximately C$199.5 million.

Yamana plans to acquire the Wasamac and the Camflo properties and mill through the acquisition of all of the shares of Monarch that it does not already own, for C$0.63 per Monarch share.

The consideration to be paid by Yamana consists of approximately C$60.8 million in cash, C$91.2 million in Yamana shares, and a newly-formed spin-out company valued at C$47.5 million.

Valuation

The total consideration represents a 43% premium to the closing price of Monarch shares October 30, 2020 and a 43% premium to the volume weighted average price (“VWAP”) on the TSX for the 20-day period ending on October 30, 2020.

With over 3 million ounces of gold resources, the transaction values Monarch at over US$43 per resource ounce or over US$86 per reserve ounce.

New Spin-out Company

The newly-formed spin-out company will contain:

- The Beaufor mine, the McKenzie Break property, the Croinor Gold property, the Swanson property and the Beacon Gold mill and property;

- C$14 million in cash;

- All assets and liabilities related to the SpinCo Properties.

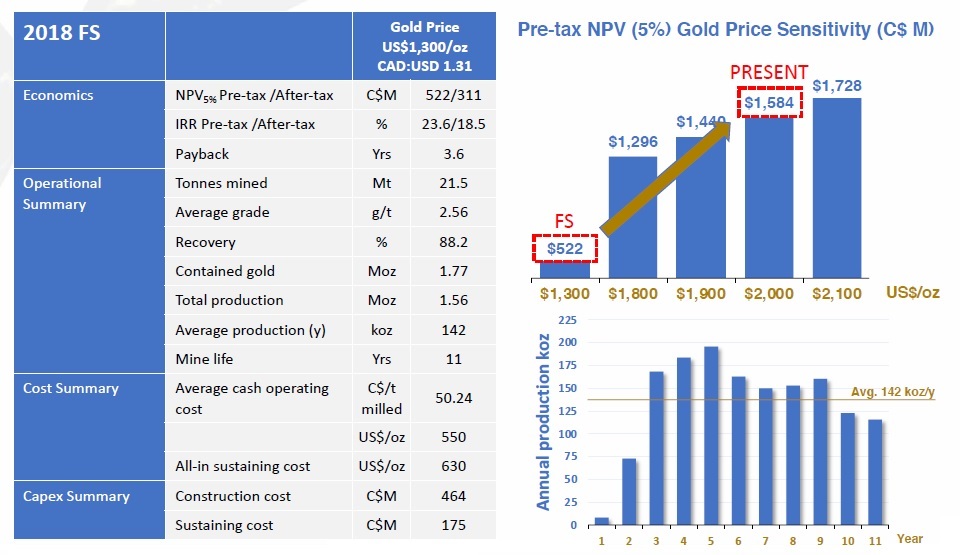

Yamana’s main focus is the Wasamac project. According to a 2018 feasibility study, the project has a proven and probable resource of 1.77 million ounces of gold and would produce 142,000 ounces annually from a mill running at 6,000 tonnes per day with a head grade of 2.56 grams per tonne. The initial CAPEX estimation was C$464 million with an all-in-sustaining cash cost of US$630 per ounce.

Yamana believes that the Wasamac fits well into their strategy that targets development projects in mining-friendly jurisdictions with gold mineral resources of over 1.5 million ounces that can support production levels of at least 150,000 ounces per year.

The companies expect to close the transaction by the end of 2020 or in early January 2021.

FIGURE 1: Wasamac Feasibility Study

Notes: All numbers in USD unless otherwise stated. The author of this report, and employees, consultants, and family of eResearch may own stock positions in companies mentioned in this article.