eResearch | In September, CloudMD Software & Services (TSXV: DOC; OTC: DOCRF) announced a series of acquisitions to expand its telehealth services. CloudMD spent approximately C$19 million on three acquisitions, including Benchmark Systems, iMD Health Global, and Snapclarity.

CloudMD is a Canadian healthcare technology company focused on SaaS-based telehealth offerings, providing services to an ecosystem of 376 clinics, 3,000 licensed practitioners, and 3 million patients.

CloudMD is a Canadian healthcare technology company focused on SaaS-based telehealth offerings, providing services to an ecosystem of 376 clinics, 3,000 licensed practitioners, and 3 million patients.

To fund its strategic M&A activities, CloudMD recently announced the closing of a C$21 million oversubscribed bought deal offering. A total of 15 million shares were issued at a price of C$1.38 per share.

Last month, CloudMD was highlighted in eResearch’s article: HealthTech Quarterly Update – Acquisitions Continue as Companies Focus on Remote Care and U.S. Expansion.

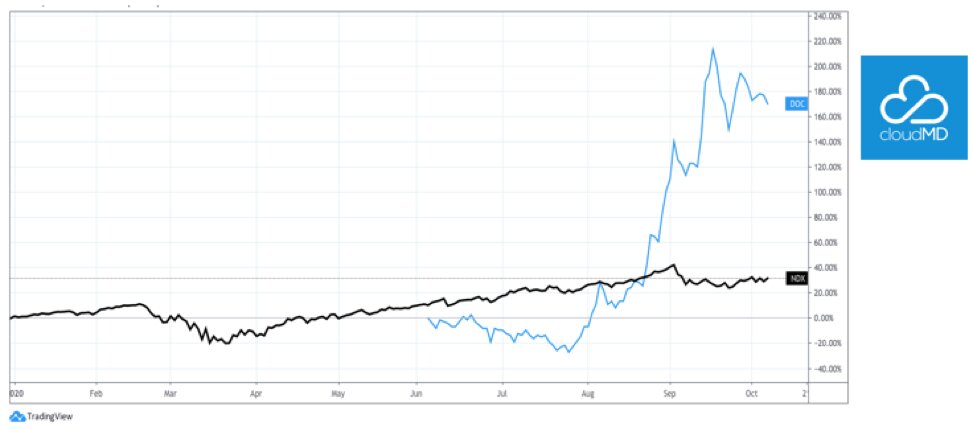

CloudMD’s stock is currently trading at C$2.00 per share, a 28% increase in the past month and a 170% increase since listing on the TSX Venture exchange in June.

Benchmark Systems

At the end of last month, CloudMD announced a $4.4 million majority stake acquisition in Benchmark.

At the end of last month, CloudMD announced a $4.4 million majority stake acquisition in Benchmark.

The acquisition is expected to be paid in cash, after which CloudMD will own an 87.5% equity stake in Benchmark. Benchmark’s parent company, AntWorks, is expected to retain the remaining 12.5% stake.

Benchmark is a 42-year-old telehealth company focused on leveraging artificial intelligence (“AI”) and cloud technologies to automate healthcare processes and services.

Benchmark provides various integrated telehealth solutions, which support the management of electronic records, bill processing, and operational scheduling.

In the U.S., Benchmark has a network of 200 clients and 800 physicians, with 5.5 million patient charts across 35 states. Every month, Benchmark experiences approximately $2.5 million in gross payment charges.

For the fiscal year ended March 31, 2020, Benchmark generated approximately $4.9 million in revenue, with an EBITDA margin of 13%. Recurring software service sales accounted for 80% of total revenue.

CloudMD plans to leverage Benchmark’s leading AI assets to enhance research and product development of telehealth offerings.

CloudMD also expects to leverage Benchmark’s distribution network in the U.S., by integrating various telehealth solutions into Benchmark’s U.S. operations.

In the press release, Dr. Essam Hamza, CEO of CloudMD, spoke on how the acquisition will support CloudMD’s U.S. expansion plans, as he said,

“We believe that Benchmark will expedite our U.S. expansion efforts and enhance the quality, operations and scalability of our business. Benchmark is already well-established in the marketplace and their significant U.S. presence will help us navigate individual state requirements, while providing opportunities for existing software integration, cross selling and revenue optimization.”

iMD Health Global

Last month, CloudMD announced a C$10 million acquisition of iMD. iMD is backed by Apotex, a leading Canadian pharmaceutical company that owns an 18% equity stake in iMD.

Last month, CloudMD announced a C$10 million acquisition of iMD. iMD is backed by Apotex, a leading Canadian pharmaceutical company that owns an 18% equity stake in iMD.

Deal Structure:

- C$1.5 million in Cash.

- C$4.5 million in CloudMD

- C$4.0 million in CloudMD shares, subject to a performance-based agreement.

iMD is a software development company that curates medical information through a digital library with over 80,000 patient resources, which cover more than 2,000 health conditions.

iMD’s platform provides health professionals with an easy way to share diagnoses and treatment plans with patients. The platform is currently used by 7.5 million patients and over 10,000 healthcare professionals, across 60 healthcare associations.

Content on iMD’s platform includes peer-reviewed resources licensed from partners such as Mayo Clinic Library. iMD also sources content from pharmaceutical partners, including AstraZeneca (LON: AZN), Bayer (ETR: BAYN), Johnson & Johnson (NYSE: JNJ), Novartis (SWX: NOVN), and Sanofi (EPA: SAN).

FIGURE 1: IMD’s Platform

Based on contracts signed to date, iMD currently has C$1.2 million in annualized revenue. In addition, iMD is operating at nearly break-even, while continuing to invest into intellectual property.

iMD’s platform is expected to be integrated into CloudMD’s electronic medical records (“EMR”) software, Juno.

CloudMD also plans to support iMD expand its platform and operations across Canada, the U.S., Mexico, and the Middle East.

Snapclarity

After initially announcing the transaction earlier this year, CloudMD recently signed an agreement to acquire Snapclarity for C$3.35 million.

After initially announcing the transaction earlier this year, CloudMD recently signed an agreement to acquire Snapclarity for C$3.35 million.

Deal Structure:

- C$0.98 million in Cash.

- C$2.38 million in CloudMD

In addition, Snapclarity may receive up to an extra C$3.65 million in CloudMD shares, subject to a performance-based agreement.

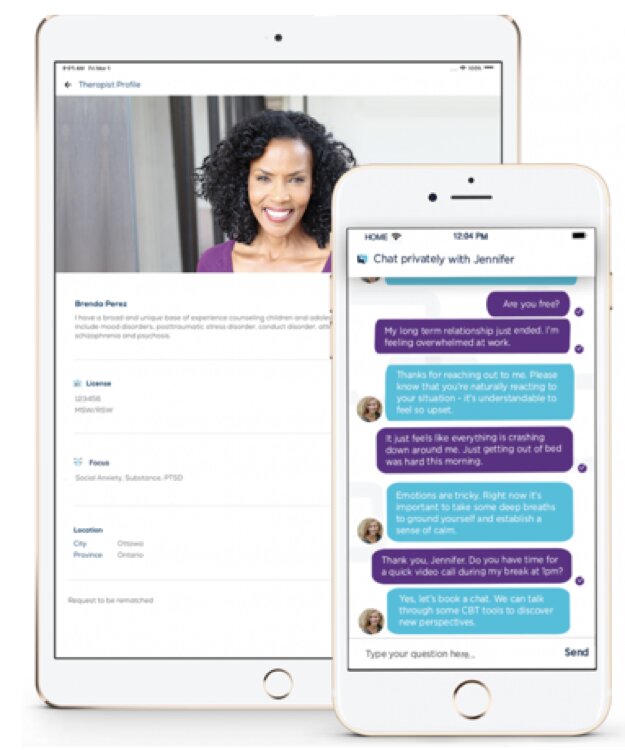

Snapclarity operates an enterprise mental health platform, which provides on-demand support for patients with mental health disorders.

FIGURE 2: Snapclarity’s Enterprise Mental Health Platform

Snapclarity’s platform assesses mental health disorders and connects patients to therapists, while providing personalized care plans and online resources.

Jeff Deriger, President of Snapclarity, made the following comment regarding the acquisition,

“A combined CloudMD and Snapclarity will remove barriers to access while providing the market with hyper personalized, integrated mental and physical health care plans. Individuals and corporations are demanding a holistic continuum of care. We look forward to introducing a continuity of care in managing health utilizing a pioneered approach in supporting an individual’s wellbeing.”

The Ontario government recently announced C$19 million in funding to support mental health, as the COVID-19 pandemic severely impacted communities. According to Dr. Hamza, over 56% of Canadians experienced negative mental health impacts due to the pandemic, mainly attributed to social isolation.

Telehealth Market

As the pandemic pushes the adoption of remote healthcare services, healthcare companies are developing and providing more telehealth technologies and innovations.

Telehealth leverages digital information and communication technologies to better manage and improve patient treatments.

According to Fortune Business Insights, the global telehealth market was valued at $61 billion last year and could potentially reach $560 billion by 2027, growing at a CAGR of 25%.

FIGURE 3: NASDAQ 100 (black) vs CloudMD (blue) – YTD Chart