Tesla’s battery day is set for Tuesday, September 20, and will follow after the Company’s Annual General Meeting.

Rumours abound about what will be revealed, including:

- A million-mile battery

- Higher density energy units

- Electric utility announcement

- Energy storage announcement

- Change in the chemical composition of the battery

On September 11, Elon Musk, CEO of Tesla, tweeted, “Many exciting things will be unveiled on Battery Day 9/22.”

The “million mile” battery is a reference to how long a battery could last in a car before breaking down. Contemporary Amperex Technology Co. Ltd (“CATL”), Tesla’s battery supplier in China, already announced their new battery that lasts 16 years and 2 million kilometers (1.24 million miles).

“Leaked” photos show a battery cell that looks like a tin, slightly larger than the old battery cells, which supposedly packs a much higher density. The goal is to reach a price target of $100 per kWh which would put the battery pack technology price point on a par with gasoline cars.

Another rumour is a long-life nickel-manganese-cobalt (NMC) rechargeable battery with more nickel and manganese, less cobalt, plus some aluminum. Manganese has the benefits of a lower cost material, compared with minerals such as cobalt but can still provide the higher density and longer battery life that is desired.

Another rumour is a long-life nickel-manganese-cobalt (NMC) rechargeable battery with more nickel and manganese, less cobalt, plus some aluminum. Manganese has the benefits of a lower cost material, compared with minerals such as cobalt but can still provide the higher density and longer battery life that is desired.

According to a report by Stratistics MRC, the global manganese alloys market accounted for $12.3 billion in 2019 and is expected to reach $21.2 billion by 2027, growing at a CAGR of 7.1%.

Canadian-listed companies that could benefit from an increase in manganese demand include:

Manganese X Energy Corp. (TSXV: MN):

Manganese X Energy Corp. (TSXV: MN):

- Manganese X Energy’s property portfolio includes the Battery Hill deposit in the Houlton-Woodstock Manganese property, consisting of 55 claims totaling 1,228 hectares located in New Brunswick. Manganese X Energy is advancing the project towards a NI 43-101 resource and is currently drilling on the project.

American Manganese Inc. (TSXV: AMY):

- American Manganese is a metals company focused on the recycling of lithium-ion batteries.

- American Manganese’s project portfolio also includes the Artillery Peak manganese deposit that has a 2012 pre-Feasibility study for the production of Electrolytic Manganese Metal (“EMM”) and another study on the production of high purity working Electrolytic Manganese dioxide (EMD).

- The project has a NI 43-101 Indicated Resource of 143.6 million tonnes at 2.98% manganese and an Inferred Resource of 54.7 million tonnes at 2.83% manganese.

Globex Mining Enterprises Inc. (TSX: GMX)

Globex Mining Enterprises Inc. (TSX: GMX)

- Globex has over 189 project properties focused primarily in North America and covering precious metals, base metals, specialty metals & minerals, and royalties.

- Globex has the Glassville manganese project in Carleton County, New Brunswick, and recently acquired 15 claims near Hartland, New Brunswick, covering the Glassville South manganese zone.

Euro Manganese Inc. (TSXV: EMN)

- Euro Manganese is focused on the development of the Chvaletice Manganese project in the Czech Republic. The project will recycle historic mine tailings from Europe’s largest manganese deposit.

- The project has a NI 43-101 Measured and Indicated Resource of 26.9 million tonnes, grading 7.33% total manganese and 5.86% soluble manganese.

Giyani Metals Corp. (TSXV: EMM)

Giyani Metals Corp. (TSXV: EMM)

- Giyani is focused on the development of its K.Hill, Lobatse, and Otse manganese projects in Botswana, Africa.

- Giyani completed a Preliminary Economic Assessment (“PEA”) in April 2020 on the K.Hill project. The PEA resulted in a Net Present Value of $275 million, at a 10% discount rate, over a 10-year mine life, and an initial CapEx of $110 million with a manganese price of $4,700 per tonne for a 99.9% electrolytic manganese (“HPEMM”) product destined for the battery production market.

- The K.Hill project has a 43-101 Inferred Resource of 1.24 million tonnes at a grade of 27.3% manganese oxide.

Electric Royalties Ltd. (TSXV: ELEC)

- Electric Royalties focuses on investing in and acquiring royalties in mines and projects with a focus on commodities that will benefit from electric vehicles, rechargeable batteries, energy storage, and solar and other renewables.

- In July, Electric Royalties acquired a 2% Gross Metal Royalty (“GMR”) on Manganese X Energy’s Battery Hill deposit.

A.I.S. Resources Limited (TSXV: AIS)

A.I.S. Resources Limited (TSXV: AIS)

- A.I.S. is a mineral exploration company that is advancing the Toolleen-Fosterville and Yalgogrin gold projects in Australia.

- A.I.S. also has a joint venture with the San Jorge mine in Peru, to direct ship manganese ore at a grade of 42% manganese, and a separate joint venture with a mine in Zambia, to direct ship manganese ore at a grade of 53% manganese.

- A.I.S. completed its first test shipment in January 2020 but the COVID 19 restrictions severely affected demand for manganese in the first quarter of 2020. A.I.S. is monitoring the manganese market to determine the right time to recommence manganese activities.

//

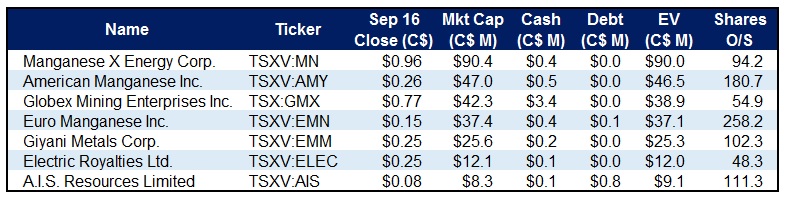

CHART 1: Canadian Public Companies with Exposure to Manganese

Manganese X Energy Corp. (TSXV: MN):

Manganese X Energy Corp. (TSXV: MN): Globex Mining Enterprises Inc. (TSX: GMX)

Globex Mining Enterprises Inc. (TSX: GMX) Giyani Metals Corp. (TSXV: EMM)

Giyani Metals Corp. (TSXV: EMM) A.I.S. Resources Limited (TSXV: AIS)

A.I.S. Resources Limited (TSXV: AIS)