eResearch | Companies focused on remote workplace technologies recently reported quarterly earnings, including Dropbox (NASDAQ: DBX), Slack Technologies (NYSE: WORK), and Zoom Video Communication (NASDAQ: ZM).

The COVID-19 pandemic continued to facilitate the adoption of various platforms and services for remote working, with offerings that support cloud storage, workplace communication, and video conferencing.

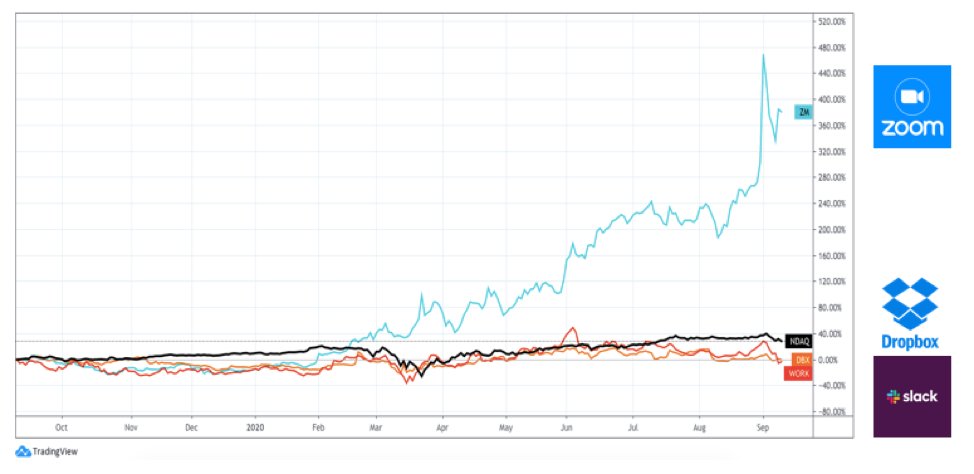

Zoom’s stock price soared as it reported a 355% increase in revenue year-over-year, compared with Dropbox and Slack, who reported revenue increases of 16% and 49%, respectively.

Zoom

In FQ2/2021, for the three months ended June 30, 2020, Zoom reported Revenue of $664 million versus S&P Capital IQ analysts’ consensus estimate of $500 million, with an EPS of $0.63 versus the consensus estimate of $0.37.

In FQ2/2021, for the three months ended June 30, 2020, Zoom reported Revenue of $664 million versus S&P Capital IQ analysts’ consensus estimate of $500 million, with an EPS of $0.63 versus the consensus estimate of $0.37.

Zoom experienced a 355% increase in revenue year-over-year, as the pandemic facilitated the adoption of its platform, with large enterprises transitioning from legacy systems to Zoom’s services, such as Zoom Meeting, Zoom Rooms, and Zoom Phone.

This past quarter, Zoom grew its number of paid customers with more than 10 employees to 370,200 customers, a 458% increase year-over-year. In addition, 100,000 K-12 schools signed up to use Zoom’s free-service offering during the pandemic.

ExxonMobil (NYSE: XOM), a leading international energy company, recently chose Zoom for its communication platform, to enable reliable and secure collaboration between ExxonMobil’s teams, customers, and partners around the world.

Activision Blizzard (NASDAQ: ATVI), one of the largest gaming publishers in the world, also partnered with Zoom to consolidate and transition all of Activision’s business units and game franchise teams to a single communication platform. Activision plans to commit a full enterprise rollout of Zoom Meeting and Zoom Rooms.

ServiceNow (NYSE: NOW), a cloud platform operator who has been an existing Zoom customer since 2018 with over 11,000 global employees using Zoom Meetings, recently replaced a legacy phone system with Zoom Phone to improve one-touch communication and collaboration.

On the earnings call, Eric Yuan, CEO of Zoom, said,

“As remote work trends have accelerated during the pandemic, organizations have moved beyond addressing immediate business continuity needs to actively redefine and embracing new approaches to support a future of working anywhere, learning anywhere, and connecting anywhere. And we continued to see meaningful adoption of Zoom’s video-first unified communication platform across industries and geographies.”

Zoom’s stock is currently trading at $384.96 per share, an 18% increase since the earnings announcement, and a 376% increase in the past year.

FQ3/2021 Guidance

- Revenue between $685 million and $690 million.

- Non-GAAP Operating Income between $225 million and $230 million.

- Non-GAAP Diluted EPS between $0.73 and $0.74.

FY2021 Guidance (raised)

- Revenue between $2.37 billion and $2.39 billion.

- Non-GAAP Operating Income between $730 million and $750 million.

- Non-GAAP Diluted EPS of $2.40 and $2.47

Dropbox

In Q2/2020, for the three months ended June 30, 2020, Dropbox reported Revenue of $467 million versus S&P Capital IQ analysts’ consensus estimate of $465 million, with an EPS of $0.04 versus the consensus estimate of a loss of $0.01.

In Q2/2020, for the three months ended June 30, 2020, Dropbox reported Revenue of $467 million versus S&P Capital IQ analysts’ consensus estimate of $465 million, with an EPS of $0.04 versus the consensus estimate of a loss of $0.01.

Dropbox experienced a 16% increase in revenue, year-over-year, driven by a surge in paying users, as larger enterprises transitioned operations over to Dropbox’s platform.

Total Annual Recurring Revenue (“ARR”) reached $1.9 billion, a 17% increase year-over-year, as the number of paying users of Dropbox’s platform increased to 15 million, a 10% increase year-over-year. Dropbox also increased the number of business teams on its platform to over 500,000.

The University of Michigan recently announced a partnership with Dropbox, with plans to deploy Dropbox Education campus-wide to support students with tools for remote collaboration and increased accessibility.

Divimove (www.divimove.com), a Europe-based media marketing company, recently announced plans to migrate its content over to Dropbox’s platform, to support the management and optimization of Divimove’s whole content creation life cycle from concept ideation to final delivery.

This past quarter, Dropbox fully integrated with its subsidiary HelloSign, an e-signature company acquired last year, who recently expanded its e-signature tool by 21 additional languages. Dropbox is currently developing multiple HelloSign products, such as HelloFax, a digital fax solution that recently began trials.

Drew Houston, CEO of Dropbox, said,

“It’s clear to me that the shift to distributed work will ultimately be as significant as the shift to mobile or the shift to cloud, and all knowledge workers need new and better ways to organize their working lives in this new environment. We’ve completely reoriented our product road map since March and see many opportunities to design new products and experiences for distributed work, and I’m excited to share more of what we’ve been working on in the second half of the year.”

Ajay Vashee, CFO of Dropbox announced he is stepping down, with Tim Regan, the current Chief Accounting Officer, stepping in for the role of CFO.

Dropbox’s stock price is currently trading at $19.91 per share, a 14% decrease since the earnings announcement, and a 1% decrease in the past year.

Q3/2020 Guidance

- Revenue between $481 million and $484 million.

- Operating Margin between 17.5% and 18%.

FY2020 Guidance (raised)

- Revenue between $1.89 billion and $1.9 billion.

- Operating Margin between 18% and 18.5%.

- Free Cash Flow between $465 million and $475 million.

Slack

In FQ2/2021, for the three months ended July 31, 2020, Slack reported Revenue of $216 million versus S&P Capital IQ analysts’ consensus estimate of $209 million, with an EPS loss of $0.13 versus the consensus estimate of a loss of $0.14.

In FQ2/2021, for the three months ended July 31, 2020, Slack reported Revenue of $216 million versus S&P Capital IQ analysts’ consensus estimate of $209 million, with an EPS loss of $0.13 versus the consensus estimate of a loss of $0.14.

Slack grew revenue 49% year-over-year, as it added 8,000 new paid customers, bringing the total up to 130,000, which included 87 paid customers with greater than $1 million in annual recurring revenue compared with 49 in the previous comparable year’s quarter.

As more consumers stayed home due to the pandemic, Slack experienced higher growth rates in net new paid customers in June and July compared with April and May, with the trend continuing in August.

Slack recently signed new deals and extended existing deals with various customers, including Sony Network Communications, a division of Sony Corp. (TSE:6758), Shopify (TSX: SHOP), IRIS Ohyama (www.irisohyama.co.jp), Kindai University (www.kindai.ac.jp), Peloton Interactive (NASDAQ: PTON), LPL Financial (NASDAQ: LPLA), NTT Data (TYO: 9613), and Alnlam Pharmaceuticals (NASDAQ: ALNY).

This past quarter, Slack also announced a multi-year partnership with Amazon Web Services (“AWS”), a cloud computing platform operated by Amazon.com (NASDAQ: AMZN), to enable the management of AWS’ resources on Slack’s platform. Slack is expected to migrate services such as Slack Calls over to Amazon Chime.

Slack prices its platform subscriptions on a per-seat basis, which negatively impacted Slack during the pandemic as distressed companies reduced costs through short-term solutions such as freezing hiring or canceling seats on Slack’s platform.

On the earnings call, Allen Shim, CFO of Slack, spoke about COVID-19 impacts as he stated,

“As discussed last quarter, to support distressed customers, we have continued to offer credits, installment billings and billing duration of less than one year. In Q2, calculated billings were impacted by approximately $4 million of COVID-related concessions and contract duration-related headwinds. This brings the total concessions-related billings headwind in the first half to approximately $11 million.”

Slack’s stock price is currently trading at $25.88 per share, a 9% decrease since the earnings announcement, and a 3% decrease in the past year.

FQ3/2021 Guidance

- Revenue between $222 million and $225 million.

- Non-GAAP Operating Loss between $27 million and $23 million.

- Non-GAAP EPS Loss between $0.06 to $0.05.

FY2021 Guidance

- Revenue between $870 million to $876 million.

- Non-GAAP Operating Loss between $75 million and $70 million

- Non-GAAP EPS Loss between $0.14 and $0.13.

CHART 1: NASDAQ 100 (black) vs DBX (orange), WORK (red), and ZM (blue)

Previous quarter’s remote working industry update article published by eResearch: