eResearch | Yesterday, NVIDIA Corp (NASDAQ: NVDA) released its FQ2/2021 results for the quarter ended July 26, 2020.

eResearch | Yesterday, NVIDIA Corp (NASDAQ: NVDA) released its FQ2/2021 results for the quarter ended July 26, 2020.

Headquartered in Santa Clara, California, NVIDIA designs, develops, and markets graphics processor units (“GPU’s”), system on a chip units (“SoC’s”) and related software, and focuses on the gaming, automotive and mobile computing markets.

FQ2/2021 Financial Results

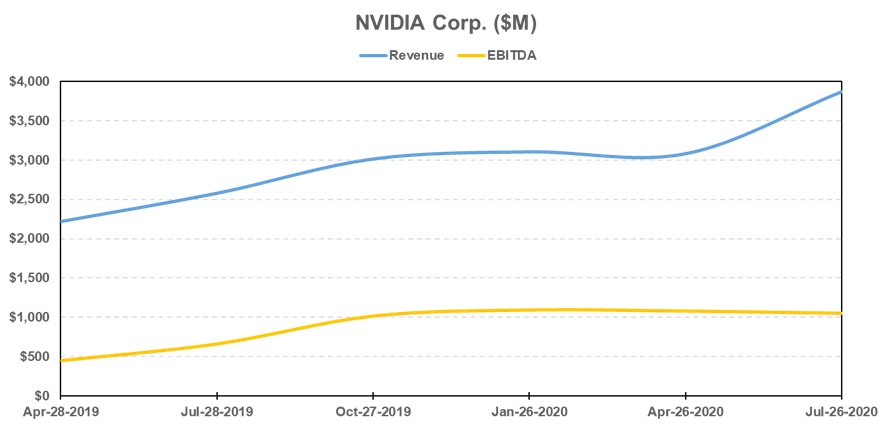

NVIDIA announced a 50% revenue growth, reaching a record of $3.87 billion in the second quarter of fiscal 2021, versus $2.58 billion reported in FQ2/2020, and a 26% revenue growth on a quarterly comparison. Analysts’ consensus revenue estimate was $3.66 billion.

Gross margin reached 66%, showing an increase of roughly 6% year-over-year due to a change in product mix with higher data center sales and lower automotive sales.

Operating expenses were higher by 38% from a year ago and 67% from last quarter, totaling $1.04 billion. Lastly, the Company delivered EPS of $2.18 and $1.57 billion in cash flow from operations.

“Our new Ampere GPU architecture is sprinting out of the blocks, with the world’s top cloud service providers and server makers moving quickly to offer NVIDIA accelerated computing. Mellanox grew sharply, driven by the need for high-speed networking in cloud data centers to scale-out AI services. And Mercedes-Benz’s partnership with NVIDIA to power its next generation fleet of luxury cars — from the computer to the AI software, and from the cloud to the car — is transformative”, said Jensen Huang.

Business Lines Highlights

1. Data Center

NVIDIA is reaping the benefits of the acquisition of Mellanox Technologies. Data center quarterly revenue was $1.75 billion, up 167% year-over-year, aided by the Mellanox acquisition that closed on April 27, 2020. Ethernet shipments reached a new record, boosting Mellanox’s revenue growth.

NVIDIA is reaping the benefits of the acquisition of Mellanox Technologies. Data center quarterly revenue was $1.75 billion, up 167% year-over-year, aided by the Mellanox acquisition that closed on April 27, 2020. Ethernet shipments reached a new record, boosting Mellanox’s revenue growth.

Additionally, the data center launched the Ampere architecture. The first Ampere GPU, the A100, is the largest chip ever made with 54 billion transistors and has been used by a wide range of vendors and cloud service providers such as Google (Nasdaq:GOOG.L) Cloud Platform, Microsoft (Nasdaq:MSFT) Azure, Amazon (Nasdaq:AMZN) AWS, Alibaba (NYSE:BABA) Cloud, Baidu (Nasdaq:BIDU) Cloud, Tencent (SEHK:700) Cloud, Cisco (Nasdaq:CSCO), Dell (NYSE:DELL), Hewlett Packard (NYSE:HPQ) and Lenovo (SEHK:992).

2. Gaming

Quarterly Gaming revenue increased 26% year-over-year and 24% quarter-over-quarter to reach $1.65 billion, beating NVIDIA‘s previous guidance.

Research published on the gaming industry indicated a 25% growth in users when compared to pre-pandemic data. Additionally, U.S. spending on video games reached $11 billion in the second quarter, representing a 30% growth.

The Company also announced that NVIDIA RTX ray tracing and DLSS AI super resolution are now supported by several video game producers and the expansion of the GeForce Now to Chromebooks.

3. Professional Visualization

Revenue from the Professional Visualization division was $203 million in FQ2/2020, down 30% from the same quarter last year and down 24% from last quarter.

The closure of many offices lowered enterprise demand but this was partially offset by companies enabling remote workers that increased demand for virtual and cloud-based graphic solutions.

The Company continues to expand their market opportunity in the space with over 50 leading design and creative applications that are NVIDIA RTX-enabled, including the latest release from Foundry, Chaos Group and Maxon.

4. Automotive

Even though auto production bottomed in April, the Automotive division was the hardest hit due to the COVID-19 shutdowns, but revenue in the quarter was higher than the Company anticipated. Automotive revenue was $111 million, down 47% on a year-over-year basis and by 28% from FQ1/2021.

Even though auto production bottomed in April, the Automotive division was the hardest hit due to the COVID-19 shutdowns, but revenue in the quarter was higher than the Company anticipated. Automotive revenue was $111 million, down 47% on a year-over-year basis and by 28% from FQ1/2021.

In June, NVIDIA announced a partnership with Mercedes-Benz (XTRA:DAI) in which a new software will be integrated in every vehicle as of 2024. This software will be built on the NVIDIA DRIVE AV autonomous driving software and NVIDIA AGX Orin™ AV computer.

FQ3/2021 Outlook

NVIDIA’s management provided guidance for FQ3/2021 and expects revenue to reach $4.4 billion with gross margins around 65.5%. Operating expenses are expected to reach $1.09 billion.

Revenue is expected to be driven by:

- 25% growth in the Gaming division

- Slight growth in the Data Center division

- Professional Visualization and Automotive divisions to maintain similar levels

However the Company did state in their financial statement,

“As the COVID-19 pandemic continues, the timing and overall demand from customers and the availability of supply chain, logistical services and component supply may have a material net negative impact on our business and financial results.”

NVIDIA’s stock closed the week at $507.34, up 9.7% on the week and currently trades at 23.7x Revenue and 67.8x EBITDA.

CHART 1: NVIDIA – Revenue and EBITDA Quarterly Chart

Other eResearch articles on NVIDIA:

- May 28, 2020: AMD, Intel, and NVIDIA Report First Quarter Earnings While the U.S. Cuts Off Huawei’s Semiconductor Suppliers

- March 22, 2020: Increase in Video Gaming Activity Due to Covid-19; eSports Focuses on Online Events

- August 16, 2019: NVIDIA’s Revenue Down Year-over-Year But Analysts’ Beat Moves Stock Higher

//