eResearch | Technology companies offering cloud products and services recently reported quarterly earnings, including Alibaba Group (NYSE: BABA; HKG: 9988), Alphabet (NASDAQ: GOOGL), Amazon (NASDAQ: AMZN), IBM (NYSE: IBM), Microsoft (NASDAQ: MSFT), and Oracle (NYSE: ORCL).

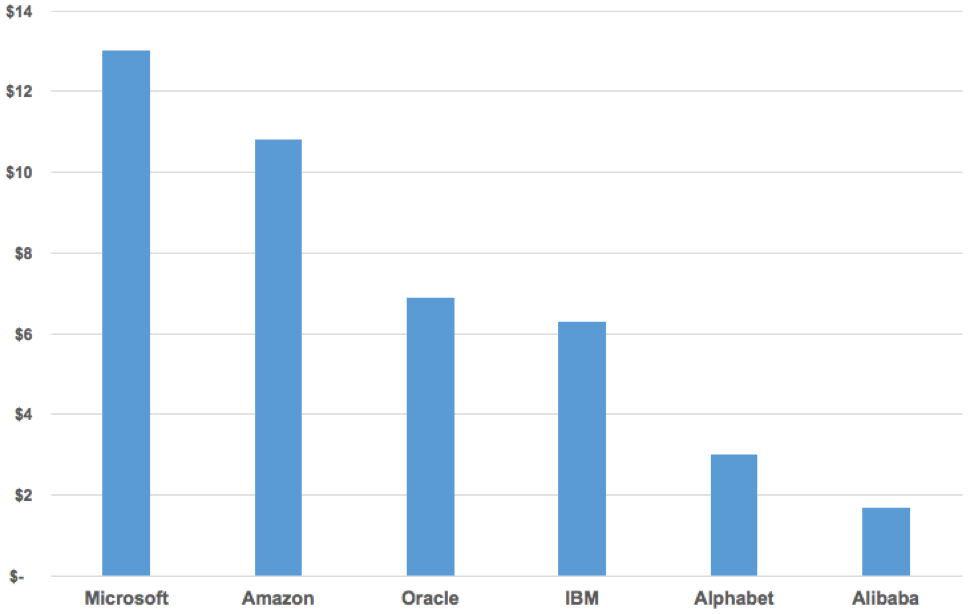

CHART 1: Q2/2020 Cloud Industry Revenues ($B)

According to Gartner, this year, the global public cloud services market is expected to reach $266 billion, a 17% increase year-over-year, led by segments Software as a Service (“SaaS”) and Infrastructure as a Service (“IaaS”), which are expected to grow to $116 billion and $50 billion, respectively.

Alibaba

In FQ1/2021, for the three months ended June 30, 2020, Alibaba’s cloud platform, Alibaba Cloud, reported Revenues of $1.7 billion, a 59% increase year-over-year, accounting for 8% of Alibaba’s total revenue.

Last year, Alibaba migrated core systems from its e-commerce business over to its public cloud infrastructure, which enabled the processing of 544,000 orders per second and 970 petabytes of data per day. The integration is expected to generate greater efficiencies for the e-commerce systems, while encouraging more customers to adopt Alibaba’s cloud infrastructure.

Last month, Alibaba announced plans to support the Paris 2024 Olympics with cloud computing and infrastructure, as it recently became an official cloud service provider for the International Olympic Committee (“IOC”).

Alibaba is expected to support the IOC with data centre infrastructure, visualization services, and security services, to enhance engagement between fans, organizers, venues, and athletes.

In light of COVID-19, to support the discovery of vaccines and treatments, Alibaba Cloud made its computing power available free to public research institutions. In addition, to accelerate COVID-19 diagnostics, Alibaba cloud offered its cloud-based artificial intelligence (“AI”) technology for applications such as computed tomography (“CT”) imagery analytics.

On the earnings call, Daniel Zhang, CEO of Alibaba, said,

“Today, Alibaba‘s cloud is cloud plus intelligence services, and it’s about cloud plus the power of data usage. So that’s why we are working hard to develop industry-specific solutions with PaaS and IaaS services together with our SaaS partners, and we will continue to do that to enhance our market leadership.”

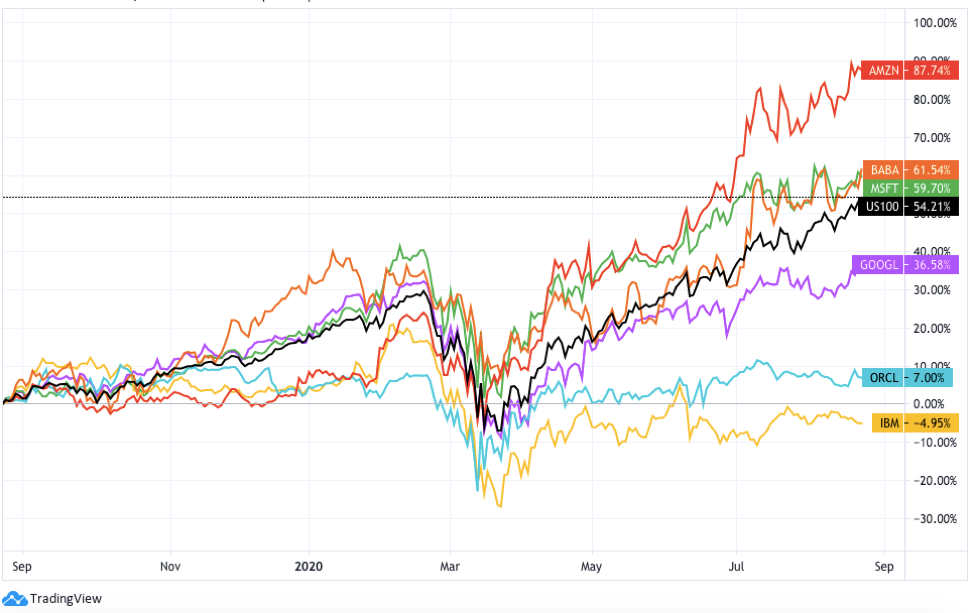

Alibaba’s stock is currently trading at $265.80 per share, a 20% increase this year and a 61% increase in the past year.

Alphabet

In Q2/2020, for the three months ended June 30, 2020, Alphabet’s cloud segment, Google Cloud, reported Revenues of $3 billion, a 43% increase year-over-year, accounting for 8% of Alphabet’s total revenues.

In Q2/2020, for the three months ended June 30, 2020, Alphabet’s cloud segment, Google Cloud, reported Revenues of $3 billion, a 43% increase year-over-year, accounting for 8% of Alphabet’s total revenues.

Alphabet is driving growth for Google Cloud through signing large customers who are making multi-year commitments, as it currently has a backlog of $15 billion in performance obligations, most of which are related to cloud engagements.

Last month, Alphabet announced a key global cloud infrastructure partnership with Box, Inc. (NYSE: BOX), a cloud content management company who has been using Google Cloud since 2016. Box also has existing cloud contracts with other providers including Amazon, IBM, and Microsoft.

Alphabet is expected to create a seamless and secure environment for clients who use G Suite’s family of cloud computing, productivity, and collaboration tools with Box’s platform, through various integrations to improve efficiencies, performance, and scale.

As Google Cloud quickly becomes a major revenue stream, Alphabet focused the majority of its hiring this past quarter within cloud operations, for both technical and sales roles.

On the earnings call, Sundar Pichai, CEO of Alphabet, said,

“The future of business will be more digital. Customers are choosing Google Cloud to either lower their cost by improving operating efficiency or to drive innovation through digital transformation.”

Alphabet’s stock is currently trading over $1,575 per share, a 15% increase this year and a 35% increase in the past year.

Amazon

In Q2/2020, for the three months ended June 30, 2020, Amazon’s cloud segment, Amazon Web Services (“AWS”), reported Revenues of $10.8 billion, a 29% increase year-over-year, accounting for 12% of Amazon’s total revenues.

In Q2/2020, for the three months ended June 30, 2020, Amazon’s cloud segment, Amazon Web Services (“AWS”), reported Revenues of $10.8 billion, a 29% increase year-over-year, accounting for 12% of Amazon’s total revenues.

AWS recently announced a multi-year partnership with Slack Technologies Inc. (NYSE: WORK), an online workplace communications platform, who is expected to migrate all voice and video calling capabilities to Amazon Chime, AWS’ cloud-based communication service.

Other new AWS customer commitments include HSBC Holdings plc (LON: HSBA), IHS Markit Ltd. (NYSE: INFO), Formula 1, Bundesliga, Capella Space, and Genesys International Corp Ltd. (NSE: GENESYS), who are all expected to leverage AWS’ various cloud management products and services to facilitate digital transformation initiatives.

The World Health Organization (“WHO”) recently launched the WHO Academy app through AWS, which provides support to health professionals around the world by enabling access to a rapidly expanding bank of COVID-19 resources, workshops, and data.

On the earnings call, Brian T. Olsavsky, CFO of Amazon, said,

“We’re also seeing a lot of companies that are really wishing that they had made more progress on the cloud because they’re seeing how companies that are on the cloud can turn into a variable cost and either scale up or scale down depending on their particular situation. They realize their on-premise infrastructure is not flexible to go up or down. And especially in the time of sinking demand, it’s a big fixed cost for them. So we expect to see migration plans accelerate.”

Amazon’s stock price is currently trading at over $3,284 per share, a 73% increase this year and an 88% increase in the past year.

International Business Machines Corporation

International Business Machines Corporation

In Q2/2020, for the three months ended June 30, 2020, IBM reported cloud Revenues of $6.3 billion, a 30% increase year-over-year., accounting for 35% of IBM’s total revenue.

IBM is currently focused on supporting clients’ transition over to its hybrid cloud platform by leveraging its recent $34 billion acquisition of Red Hat Inc., while offering enterprise-ready, containerized software solutions through its recently launched Cloud Paks.

Hybrid cloud solutions allow clients to operate between private cloud networks, third-party public cloud networks, and on-premise infrastructure, which eliminates the need for clients to rely on a single cloud provider, allowing flexibility for innovation, development time, and portfolio optimization.

IBM’s hybrid cloud platform has generated over $23 billion in revenue over the past year, as its clients found hybrid cloud solutions to be 2.5x more valuable than relying on a single public cloud infrastructure.

Multiple companies recently partnered with IBM to leverage hybrid cloud solutions for their own clients, including Adobe Inc. (NASDAQ: ADBE), Box, Salesforce.com, Inc. (NYSE: CRM), SAP S.E. (NYSE: SAP), and Slack.

IBM recently made two acquisitions to improve its cloud offerings, including Spanugo Inc., who offers compliance and cybersecurity capabilities for IBM’s hybrid cloud platform, and WDG Automation, who deliver AI-driven automation capabilities for IBM’s Cloud Paks offerings.

On the earnings call, Arvind Krishna, CEO of IBM, said,

“From a market perspective, while the current environment poses certain short-term challenges, it also presents long-term opportunities that IBM will seize as our clients accelerate their shift to hybrid cloud and AI. The essential work that we do in terms of running our clients’ mission-critical processes continues. More profoundly, we see that the digital transformation of businesses is accelerating.”

IBM’s stock price is currently trading over $123 per share, a 9% decrease this year and a 5% decrease in the past year.

Microsoft

In FQ4/2020, for the three months ended June 30, 2020, Microsoft’s cloud segment, Intelligent cloud, reported Revenues of $13.4 billion, a 17% increase year-over-year, accounting for 35% of Microsoft’s total Revenues.

Microsoft is focused on scaling its Azure cloud platform with new data centers built in Italy, New Zealand, and Poland, and new cloud offerings such as Synapse Link, which enables live analytics on real-time transactions.

As Microsoft continues to sign large multimillion-dollar commercial cloud agreements, its backlog of commitments for Azure grew to $107 billion.

Last week, Microsoft announced a partnership with Universal Filmed Entertainment Group, a global film producer and distributor, who is expected to move media production from on-premise servers to Microsoft’s cloud platform.

Other organizations who recently partnered with Microsoft’s cloud platform include Land O’Lakes, Inc., National Australia Bank Ltd. (ASX: NAB), and John Hopkins Medicine.

Next quarter, Microsoft expects its Intelligent Cloud segment to generate Revenues between $12.6 billion and $12.8 billion.

Microsoft’s stock price is currently trading over $213 per share, a 34% increase this year and a 60% increase in the past year.

Oracle

In FQ4/2020, for the three months ended May 31, 2020, Oracle’s cloud segment, Cloud Services and License Support, reported Revenues of $6.9 billion, a 1% increase year-over-year, accounting for 65% of Oracle’s total Revenues.

In FQ4/2020, for the three months ended May 31, 2020, Oracle’s cloud segment, Cloud Services and License Support, reported Revenues of $6.9 billion, a 1% increase year-over-year, accounting for 65% of Oracle’s total Revenues.

Oracle is currently servicing 24 regions with its cloud platform, Oracle Cloud Infrastructure (“OCI”), with expectations to add another 14 regions to allow more customers to operate in a public cloud without compromising data locality or data sovereignty requirements.

OCI is the world’s only second-generation autonomous cloud platform, which automatically encrypts, configures, and scales data, with no downtime required to change the number of processors or to patch new versions.

JPMorgan Chase & Co. (NYSE: JPM) recently went live in 100 countries with 256,000 employees on Oracle’s cloud platform, with over 2 million recruiting candidates on the Oracle Cloud Recruiting system.

Zoom Video Communications Inc. (NASDAQ: ZM), a leading online video-conferencing platform, recently chose Oracle as a partner to scale cloud capacity, as Zoom experienced a surge in demand for its platform due to the pandemic.

Toronto-Dominion Bank (TSX: TD), one of the major banks in Canada, recently announced a multi-year agreement to use Oracle’s cloud platform, to move financial reporting systems from on-premise infrastructure to cloud infrastructure.

Oracle’s other recently signed cloud partners include Altair Engineering Inc. (NASDAQ: ALTR), Cybereason Inc., General Authority of Civil Aviation, Jefferies Group LLC, Omani Information Technology and Communications Group, Santander Bank N.A., SGS S.A. (SWX: SGSN), Synacor Inc. (NASDAQ: SYNC), and Quest Diagnostics Inc. (NYSE: DGX).

Oracle’s stock price is currently trading at $55.19 per share, a 2% increase this year and a 7% increase in the past year.

CHART 2: NASDAQ 100 vs AMZN (red), BABA (orange), MSFT (green), GOOGL (purple), ORCL (blue), and IBM (yellow)

Last quarter’s eResearch Cloud update article:

Note: All numbers in USD unless otherwise stated.

//

International Business Machines Corporation

International Business Machines Corporation