Catherine Raw, Chief Operating Officer of Barrick Gold Corporation (TSX:ABX ; NYSE: GOLD), was the keynote speaker at the “Mineral Outlook Luncheon” at the PDAC Conference on March 2, 2020.

Ms. Raw spoke about the return of mining M&A deals in 2019, the industry and market fundamentals that fueled the deals, and her belief that mining deals will continue.

2019 M&A DEALS

Last year was the busiest year for M&A in the mining industry since 2010, when the price of gold last spiked. In 2019, there were three “Mega” deals in the mining industry:

- Barrack and Randgold Resources merger: US$6.5 billion

- Newmont Corporation (NYSE:NEM) and Goldcorp Inc. merger: US$13.0 billion

- Barrick and Newmont joint venture in Nevada to create the world’s single-largest gold producer.

“M&A is back,” she commented but “the mining industry needs to add value, not destroy value, if mining companies continue with M&A in the future.”

She noted that during the last 18 months she has seen an increase in activity across the world in the precious metals sector, with Australian companies taking advantage of their strong balance sheets and Chinese companies continuing to increase their presence around the world.

She believes that consolidation will continue because of the challenges that many mining companies are facing that are based on:

- Industry fundamentals

- Equity Market fundamentals

INDUSTRY FUNDAMENTALS

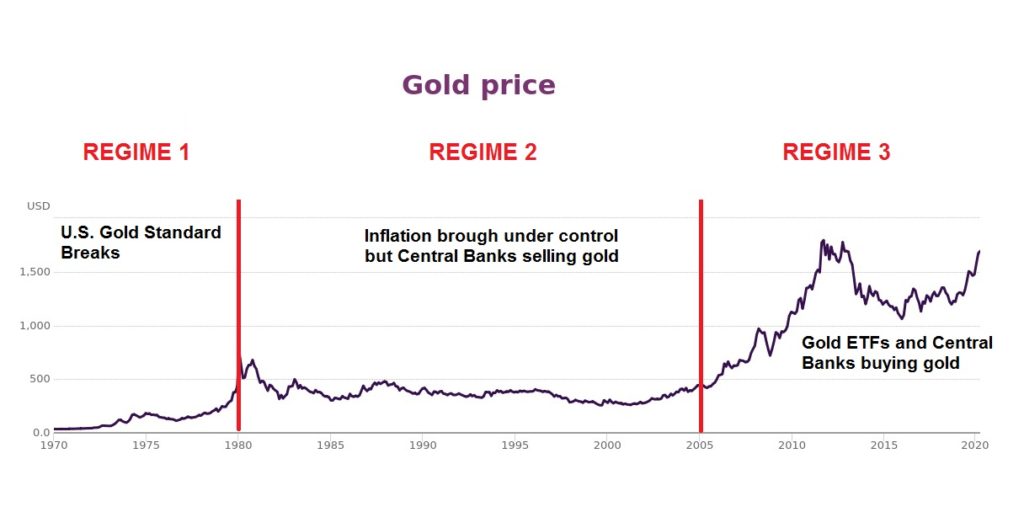

Industry fundamentals focused on the new “floor price” of gold that forms the basis for economic models. Over the last 50 years, gold traded in three regimes:

- Prior to 1980: The hyperinflation period of Bretton Woods collapsing and the U.S. going off of the gold standard.

- 1980-2005: Gold prices rallied to new levels with relative stability and Central Bank selling.

- 2005-2020: The gold rally up into 2011 caused by the demand growth from gold ETF’s and China re-entering the market as well as the lack of growth from the supply side.

Ms. Raw emphasized, “most importantly, each regime has set a new floor for the gold price.”

CHART 1: Gold Prices 1970-2020 – Each Regime Set a New Floor Price

With the new floor price of gold currently in the US$1200-$1300/ounce range, the gold industry has reset their planning around this long-term price and potential investment opportunities.

“But what I wanted to talk about is something that is much more long-term, much more structural and something that has been an issue for the gold industry for at least the last five years, but really now feels like it is taking off, and something has changed,” she said.

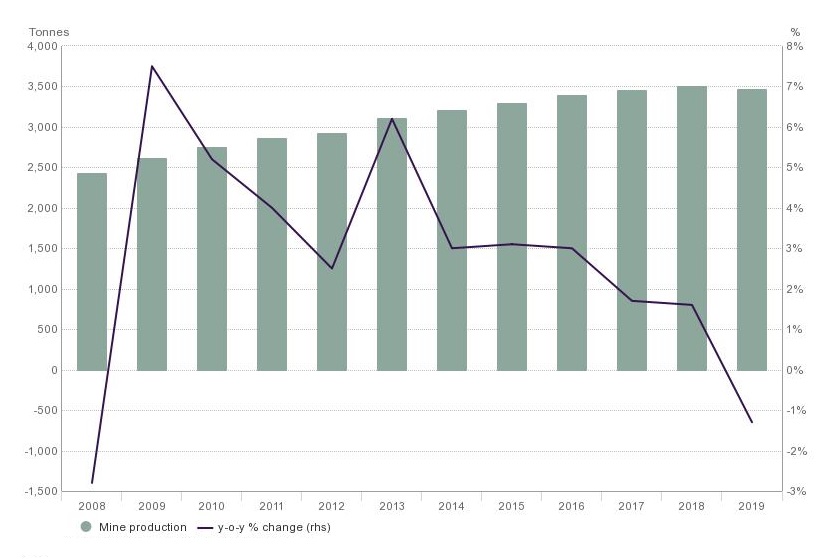

Unfortunately, she highlighted, according to the data, annual gold production plateaued in 2018. With the scarcity of new projects and the inelastic nature of the business, the end result is lower supply as highlighted in Chart 2 with production in 2019 showing a decline.

Chart 2: World Gold Production – 2019 First Year-over-Year Decline Since 2008

Apart from alluvial production – where there are elastic responses to the price of gold – overall the gold industry is inelastic, especially for large-scale projects that often have a 7-10 year lead-time.

According to Ms. Raw’s research presented, gold industry reserves are below 2007 levels and reported head grade is approaching 1.0 g/t down from over 2.5 g/t in 2000; low grade means lower margins with all else being equal.

A number of the mining companies still have balance sheet issues from the M&A that occurred during the last gold price spike in 2011 and the subsequent gold price decline through 2015 that decreased margins.

According to Ms. Raw, companies focused their limited CAPEX budgets on small-scale brownfields opportunities rather than larger greenfields projects. With a dearth of new exploration projects in the pipeline, “the gold industry is living on borrowed time effectively”, she said.

With the shrinking quantity of reserves and the deteriorating quality of grade, one way to deal with this problem is through inorganic growth: M&A.

Market Fundamentals

Shifting to the market fundamentals, according to Ms. Raw, the equity markets are not as open as before, leading to a scarcity of new capital. According to her data, 2019 had the lowest issuance of new capital in the Canadian Base & Precious Metals market for over a decade.

Resource speciality investment & mutual funds have all but disappeared and these were the driving force behind the funding for junior and mid-tier mining companies in the past.

Passive investment fund managers have taken their place and over twenty percent of the shareholder base in the gold senior companies are coming from passive investors. However, these passive fund managers have a different risk type and are not willing to fund small projects, so they focus on senior companies with better liquidity and lower risk.

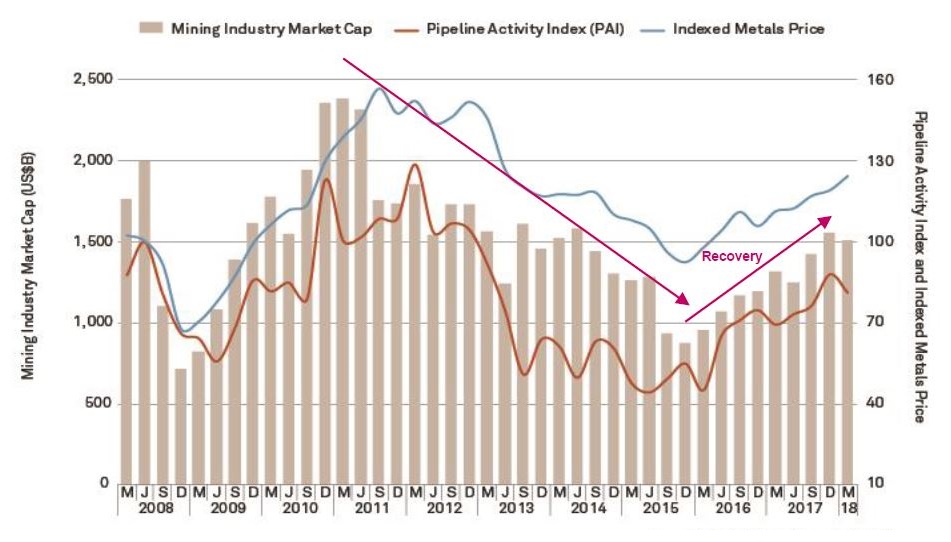

Even with the rising gold prices, Chart 3 shows the market capitalization is lagging the rising metals prices and is down more than US$500 billion from the mining industry market capitalization at similar metals prices in Q4/2010.

CHART 3: Mining Industry Market Capitalization

Another potential source of capital is the generalist fund manager. However, the generalist investor weighs their investment choice against all sectors and, due to various reasons, including a lack of liquidity and a higher risk profile, generalist investors show a lack of interest in junior mining companies.

For fund managers with the focus on liquidity, the priority is always going to be on the larger mining companies, thereby driving premium valuations compared with the mid-tier or junior resource company and enabling the senior mining companies to use their stock for acquisitions.

This scale issue should also encourage intermediate resource companies to consolidate to create larger cap and more diversified companies.

Ms. Raw concludes, “the long-term structural change is linked to the fact that specialist funds no longer invest in the mining industry and we have to appeal to the passive and the generalist investor because they are now the marginal buyer of mining stocks.”

In addition, she believes,

- M&A and consolidation is likely to continue.

- It has to continue in order to offset what would otherwise be a depletion of the resource base in the gold industry and a destruction of value.

- Therefore, the only way to be able to survive is to consolidate.

- That gives you scale. It gives you opportunity and it gives you the liquidity, all of which are going to be much more attractive to an investor base that is not used to owning the mining space.

//