After pressure from the Bank of England’s Prudential Regulation Authority (PRA), U.K.’s main banks have yielded and announced they are cutting their dividends.

After pressure from the Bank of England’s Prudential Regulation Authority (PRA), U.K.’s main banks have yielded and announced they are cutting their dividends.

Barclays (LSE: BARC), HSBC (LSE: HSBA), Lloyds Banking Group (LSE: LLOY), Royal Bank of Scotland (LSE: RBS), and Standard Chartered (LSE: STAN) all announced they would halt payouts in a co-ordinated industry response. Shares of the aforementioned companies dropped as much as 10% after the announcements were made.

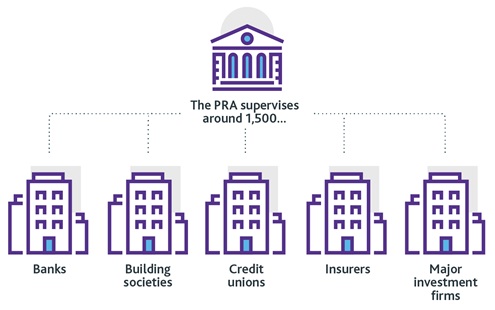

The PRU sent letters to U.K. Bank, Insurers and other Deposit-taking companies asking them to cancel 2019 dividends, and suspend dividends and share buybacks in 2020. As an example, see the letter the PRA sent to HSBC. The PRA regulates around 1,500 banks, building societies, credit unions, insurers and major investment firms in the United Kingdom.

The PRU sent letters to U.K. Bank, Insurers and other Deposit-taking companies asking them to cancel 2019 dividends, and suspend dividends and share buybacks in 2020. As an example, see the letter the PRA sent to HSBC. The PRA regulates around 1,500 banks, building societies, credit unions, insurers and major investment firms in the United Kingdom.

The PRA said U.K. banks entered the pandemic with strong capital positions, but made this request in order to preserve additional capital for use in helping clients through the current predicament and potential U.K. and global recession that might follow.

EUROPE

Last week, the European Central Bank’s (ECB) supervisory board asked European banks to limit bonuses, halt dividend payments and stop share buybacks until at least October 1, 2020, in order to preserve capital that could be used to help companies and households through the current Covid-19 crisis.

The request would affect over 100 banks in the Eurozone and the ECB estimates that this action would keep €30 billion in capital within the banking system. Some Eurozone banks have already announced their compliance including ABN AMRO (ENXTAM: ABN), Bank of Ireland (ISE: BIRG), Commerzbank (XTRA: CBK), ING Groep (ENXTAM: INGA), Société Générale (ENXTPA: GLE) and UniCredit S.p.A. (BIT: UCG).

The request would affect over 100 banks in the Eurozone and the ECB estimates that this action would keep €30 billion in capital within the banking system. Some Eurozone banks have already announced their compliance including ABN AMRO (ENXTAM: ABN), Bank of Ireland (ISE: BIRG), Commerzbank (XTRA: CBK), ING Groep (ENXTAM: INGA), Société Générale (ENXTPA: GLE) and UniCredit S.p.A. (BIT: UCG).

Banking authorities in Denmark, Norway and Sweden have also urged their banks to stop paying dividends and cancel share buyback plans.

However, Zurich-based UBS defied a request by the Swiss government and bank supervisors to limit payouts and affirmed their 2019 dividend. UBS is Switzerland’s largest bank and expects a dividend payment of US$2.64 billion.

Dividend cuts are also spreading across various industries as several large European companies, including Airbus SE (ENXTPA: AIR), innogy SE (XTRA:IGY) and Lufthansa AG (XTRA:LHA) have either cut or cancelled upcoming dividend payments.

CANADA

In Canada, with falling stock prices, dividend yields have been increasing with Canadian bank stocks now yielding between 5.3-7.6%. (BNS 6.6%, BMO 6.3%, CIBC 7.6%, National Bank 5.6%, TD 5.7%, and RBC 5.3%.) However, with concerns over the economy, especially loans to the hard-hit energy sector and out-of-work consumers, concerns have arisen about the potential for dividend cuts.

Some Canadian bank CEO’s have already commented on the potential for dividend cuts and, so far, dividends seem safe.

Bank of Montreal (TSX: BMO):

Bank of Montreal (TSX: BMO):

- On March 31, during the quarterly analysts call, CEO William Darryl White said,

- “Our 191-year legacy of paying out dividends to our shareholders is one of the longest unbroken records among companies anywhere in the world.”

- “And if you look back to the financial crisis [2008-09], I think it is significant that there was no dividend reduction at BMO or any other Canadian bank for that matter, and that was a pretty significant test.”

- “I should say that during the period of disruption, our macro prudential regulator, OSFI, expects federally regulated financial institutions not to increase their dividends for the time being.

- “But in the meantime, I’ll go back to where I was on your question of the risk of decreasing the dividend, which is that we feel pretty good that we’ve passed this test before, and we’ll pass it again.”

CIBC (TSX: CM):

CIBC (TSX: CM):

- In a March 31 interview on BNN, CIBC’s CEO Victor Dodig said that CIBC has no plans to cut its dividend because of the coronavirus pandemic.

- Link to BNN Bloomberg interview.

- Additional details could be released this week during CIBC’s Annual General meeting that is scheduled for April 8.

TD (TSX: TD):

TD (TSX: TD):

- On an Analyst call on April 02, CEO Bharat B. Masrani said,

- “We [TD] entered this period with considerable strength and strong capital position, and we are in a position, we continue to be in a position to support the recovery that will follow this crisis we have. I can also tell you that we have no plans to change our dividend policy at this time.”

Additional details from National Bank (TSX: NA), Royal Bank (TSX: RY), and Scotiabank (TSX: BNS) could be released next week as NB and RBC are holding regularly-scheduled Analyst calls, and Scotiabank is holding its Annual Meeting of Shareholders.

//

Bank of Montreal (TSX: BMO):

Bank of Montreal (TSX: BMO): CIBC (TSX: CM):

CIBC (TSX: CM): TD (TSX: TD):

TD (TSX: TD):