eResearch | The Covid-19 pandemic has stalled most economies across the world, which has given self-isolating consumers a lot of time on their hands with the internet being the only viable option to socialize or pass time safely, resulting in video-streaming companies such as Netflix (NASDAQ: NFLX) receiving massive volumes of streaming activity.

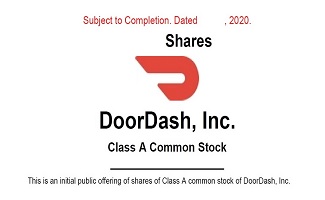

CHART 1: U.S. Growth in Over-The-Top Streaming Services (March 15-18)

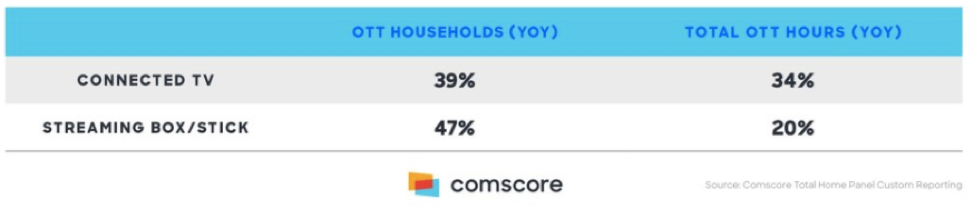

Comscore, an American media analytics company, reported a 34% and 20% increase in streaming hours on televisions and streaming systems, respectively, compared with the prior year; Netflix captured 37% of the U.S. market, with YouTube in second place at 21%.

Consumers are saturating the internet for streaming services, but the network structures currently in place do not have the capability to handle the high congestion, especially in low bandwidth areas.

In Europe, where Covid-19 has hit the hardest, the European Union has already requested a reduction in streaming quality from services including Netflix, Amazon Prime Video, Disney Plus, and YouTube, in an effort to reduce network congestion. Streaming companies have also started implementing similar quality reductions in the U.S. and Canada.

Below are three publicly traded companies in the streaming service industry:

Netflix

Netflix leads the streaming services industry as it took the advantage of being the first mover in disrupting how consumers pay to watch movies and TV-shows.

The competitive landscape has drastically changed within the streaming services industry, which has pushed Netflix to take on large amounts of debt to invest heavily into creating original content.

Last year, Netflix raised US$4.2 billion in debt to invest into content development, which has so far booked US$13.9 billion in capitalized expenses, resulting in continuous cash flow losses.

Netflix FY2019 Financial Highlights

- Revenue of US$20.2 billion, a 28% increase year-over-year, mainly due to a 20% increase in paid memberships to 27.8 million.

- Interest Expense increased to US$626 million, a 49% increase year-over-year, due to aggressive fund raising for content development and acquisition.

- Net Income of US$1.9 billion, a 54% increase year-over-year, attributed to a 5% increase in average monthly revenue per paying membership.

- Operating Cash Flow Loss of US$2.9 billion, a 7.5% increase year-over-year, mainly due to adjustments made for additions to streaming content assets of US$13.9 billion.

- Long-term debt of US$14.7 billion, a 43% increase year-over-year, due to investments in acquisitions and content creation.

- Cash and cash equivalents of US$5 billion, mainly from loans.

Disney

Walt Disney Co. (NYSE: DIS) has aggressively entered the streaming services industry at the end of last year after releasing its streaming platform, which includes Disney+, ESPN+, Hotstar, and Hulu.

Walt Disney Co. (NYSE: DIS) has aggressively entered the streaming services industry at the end of last year after releasing its streaming platform, which includes Disney+, ESPN+, Hotstar, and Hulu.

Last year, Walt Disney acquired 21st Century Fox for US$71 billion, taking control of rights for movies such as “Star Wars” and “Deadpool”, in preparation for the launch of its streaming platform.

As Walt Disney makes an entrance into the streaming services industry, similar to Netflix, Walt Disney, it is now saddled with US$48.1 billion in long-term debt due to the acquisition.

Disney FY2019 Financial Highlights (Direct-to-Consumer segment)

- Revenue of US$9.3 billion, a 174% increase year-over-year, attributed to a 170% and 320% increase in revenue from advertising and subscription fees, respectively.

- Operating expenses of US$8.5 billion, a 256% increase year-over-year, mainly due to US$6.8 billion in programming and production costs, a 331% increase year-over-year; used towards consolidation of Hulu and TFCF

- Net loss of US$1.8 billion, a 146% increase, year-over-year, attributed to a 256% and 110% increase in operating expenses and SG&A, respectively; used towards a ramp up of investments in ESPN+.

Roku

Roku Inc. (NASDAQ: ROKU) is a technology company who took a different approach in the streaming services industry by developing the Roku Player, an internet-TV adapter which provides an easier way for people at home to link media streaming services and channels to the TV.

Roku Inc. (NASDAQ: ROKU) is a technology company who took a different approach in the streaming services industry by developing the Roku Player, an internet-TV adapter which provides an easier way for people at home to link media streaming services and channels to the TV.

Roku previously did not develop or own any licensed content, but in 2017, to compete with the growing streaming industry, Roku strategically launched its own streaming platform, the Roku Channel, which through an ad-revenue sharing model, provides licensed content from partners including Lionsgate, Paramount, Sony, Warner Bros, and MGM.

Last year, Roku acquired Dataxu, a media marketplace for advertisement sales, for US$150 million, which was added to its Platforms revenue segment alongside the Roku Channel. In the last three years, the Platforms revenue segment has grown from US$225 million to US$740 million; Roku currently generates 66% of its revenue from its Platform segment and 34% of its revenue from its Roku Player.

Roku FY2019 Financial Highlights

- Revenue of US$1.1 billion, a 52% increase year-over-year, mainly due to a 78% increase in sales from its Platforms segment.

- Average revenue per user of US$23.14, a 29% increase year-over-year, due to the number of streaming hours growing to 40.3 billion hours compared with 16.3 billion hours, year-over-year.

- Gross profit of US$664 million, a 54% increase year-over-year, due to increased sales from its higher margin Platforms segment.

- Net Loss of US$60 million, a 576% increase year-over-year, attributed to a 78% and a 19% increase in R&D expenses and sales & marketing expenses, respectively.

- Cash and cash equivalents of US$515 million.

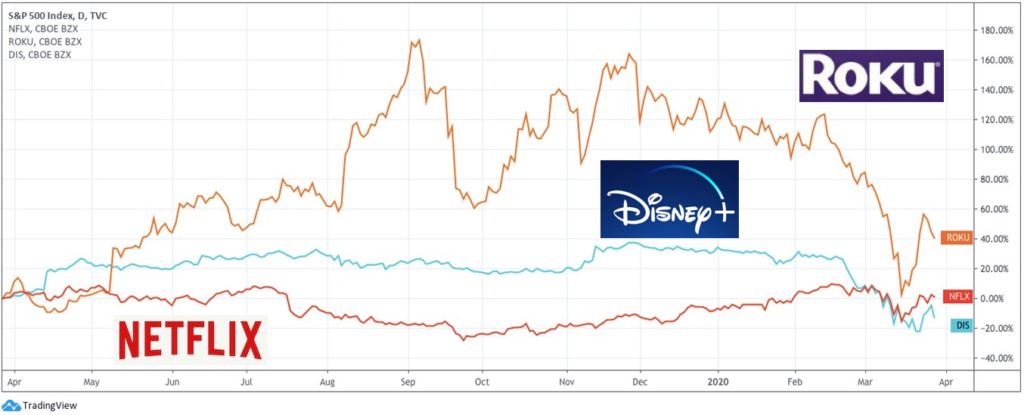

CHART 3: S&P 500 Index vs. Netflix, Roku, and Disney

//