eResearch | This week, the Fraser Institute released the 2019 Annual Survey of Mining Companies, a global survey amongst mining professionals regarding investment attractiveness for various exploration regions around the world.

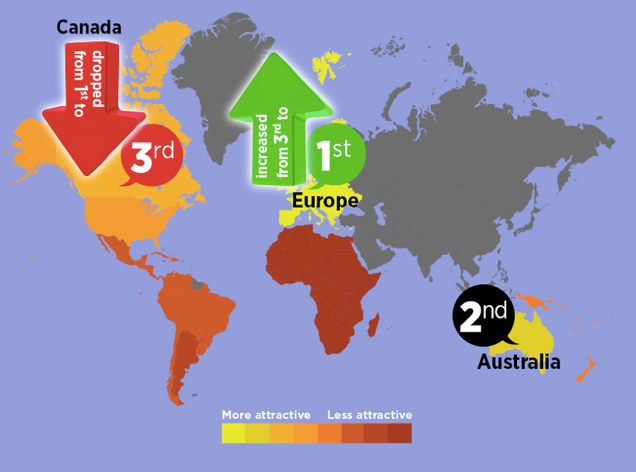

Last year, Canada was ranked as the most attractive region for exploration investments, but this year, Europe has overtaken that spot with Australia in second place; the U.S. ranks below at fourth place.

The Fraser Institute assessed how exploration investments are impacted differently across various countries with different mineral endowments and public policies such as taxation. The survey had 263 individuals who ranked 73 jurisdictions according to their attractiveness for mining investments with regards to their respective geology and public policies.

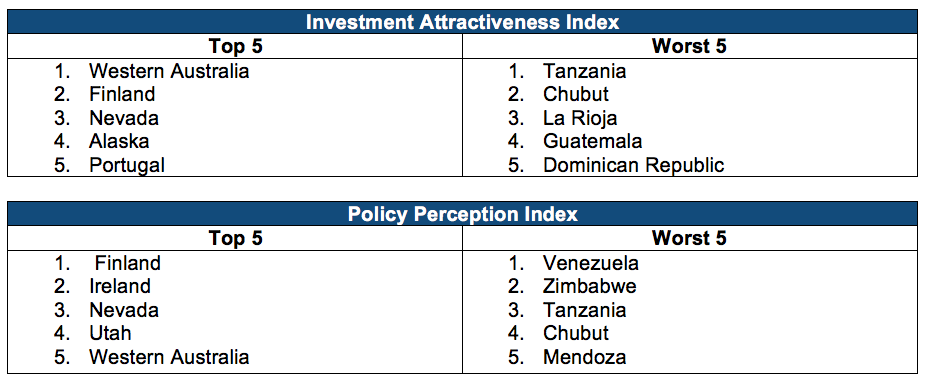

The assessment consists of two main indices, (1) the Investment Attractiveness Index, which includes measurements of geologic attractiveness, and (2) the Policy Perception Index, which measures the effects of government policy on exploration investments.

Click here to view the full Frasier Institute 2019 Annual Mining Survey

Canada

This year, Canada ranked third overall for exploration investment attractiveness but it did not have a single jurisdiction in the top 10 compared with last year when it had four. In regards to PPI, Canada had three jurisdictions in the top 10, which included Alberta, Newfoundland and Labrador, and Saskatchewan.

This year, Canada ranked third overall for exploration investment attractiveness but it did not have a single jurisdiction in the top 10 compared with last year when it had four. In regards to PPI, Canada had three jurisdictions in the top 10, which included Alberta, Newfoundland and Labrador, and Saskatchewan.

Saskatchewan – Saskatchewan is Canada’s top province on the Investment Attractiveness Index. On the PPI, Saskatchewan fell to 9th in global rankings, after having achieved the top spot last year, mainly due to increased concerns over taxes, regulatory inconsistencies, and trade barriers.

Ontario – Ontario is Canada’s second most attractive investment region and is one of the only provinces that did not drop this year in global rankings. Ontario’s global ranking in the PPI improved to 24th place compared with 30th place last year due to decreased concerns over environmental regulations and disputed land claims.

Quebec – Quebec is Canada’s third best province on the Investment Attractive Index. Quebec’s PPI fell to 21st place compared with 10th place last year, due to miners’ concerns over the environmental regulations, the administration and enforcement of existing regulations, and the socioeconomic conditions of the industry.

U.S.

U.S.

The U.S. was ranked fourth overall for investment attractiveness right behind Canada, but it saw declines in PPI scores across all states except Alaska. The U.S. continues to lead in the PPI with four states ranked in the global top 10 standings this year.

Nevada – The top state in the U.S. for investment attraction is Nevada due to its policy factors and mineral potential, and it is the third best jurisdiction in the world for exploration investments. Nevada also holds third place for the PPI, giving it the most attractive policy environment within the U.S.

Alaska – Alaska is the second most attractive state in the U.S. for exploration investments, and it was the only state that did not decline in PPI scores this year with its ranking improving to 17th compared with 26th year-over-year. Miners in Alaska had decreased concerns over environmental regulations, improvements in enforcement of existing regulations, and removed uncertainty concerning protected areas.

California – California continued to hold the bottom place among the states as the least attractive jurisdiction for investments with PPI rankings dropping to 52nd compared with 49th year-over-year. The miners in California expressed concerns regarding the state’s geological database, socioeconomic agreements, and legal system.

//