WeedMD Inc. (TSXV:WMD) closed the acquisition of Starseed Holdings Inc. and secured a C$25 million investment from Starseed’s strategic investor, the Labourers’ Pension Fund of Central and Eastern Canada, at $1.0832 per share.

WeedMD acquired 100% of the common shares of Starseed, in exchange for 71.8 million shares of WeedMD.

The acquisition values Starseed at approximately C$78 million or approximately 12x revenue.

Certain shareholders of Starseed, now holding approximately 49 million shares of WeedMD, have agreed to an 18-month lock-up agreement.

Toronto-based Starseed is a medically-focused, federally-licensed cannabis company providing cannabis to insured patients with coverage under their company benefit plans.

From the nine months ended September 30, 2019, Starseed had revenues of C$4.8 million and an Operating Loss of C$15.9 million.

From the twelve months ended September 30, 2019, WeedMD had revenues of C$20.7 million and an Operating Loss of C$10.2 million with a Net Income Loss of $10.9 million.

//

WeedMD Inc. (TSXV:WMD)

- www.weedmd.com

- Headquartered in Aylmer, Canada, WeedMD produces, distributes, and sells medical-grade cannabis in Canada.

- WeedMD sells its products directly to medical patients, as well as through supply agreements with Shoppers Drug Mart, a subsidiary of Loblaw Companies Limited (TSX:L), and provincial distribution agencies.

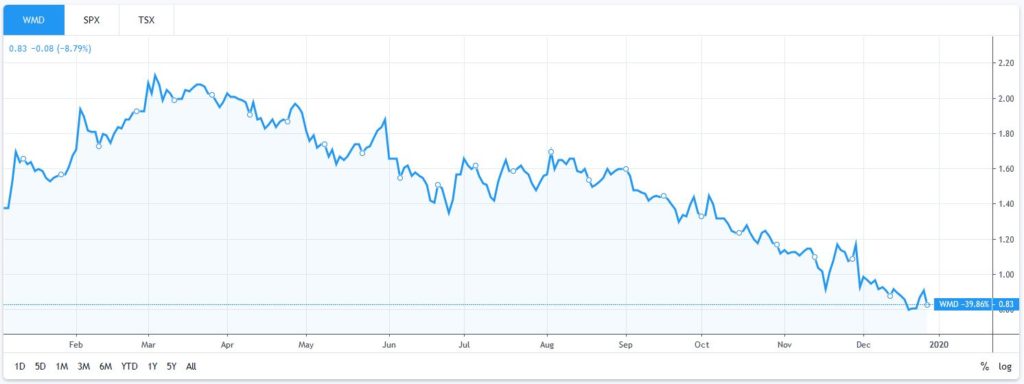

- WeedMD is currently trading at $0.83 with a market cap of C$95.2 million and a valuation multiple of Enterprise Value (EV)/Revenue of 6.1x.

Figure 1: WeedMD (TSXV:WMD) 1-Year Stock Chart