Golden Valley Mines Ltd. (TSXV:GZZ)

Golden Valley was one of the companies featured in our 70-page Project Generator Industry Report. You can download the full, 70-page Project Generator Industry Report by clicking on the following link: eR-IR-ProjectGenerators_2019-09-27_FINAL

//

Company Overview

Golden Valley is a mineral exploration company that is focused on project generation, and has direct and indirect exposure to 72 exploration properties located in the following areas: the Abitibi Greenstone Belt of Ontario and Quebec; James Bay, Quebec; the Nunavik (Ungava and Labrador) Region of Northern Quebec; and Western Australia.

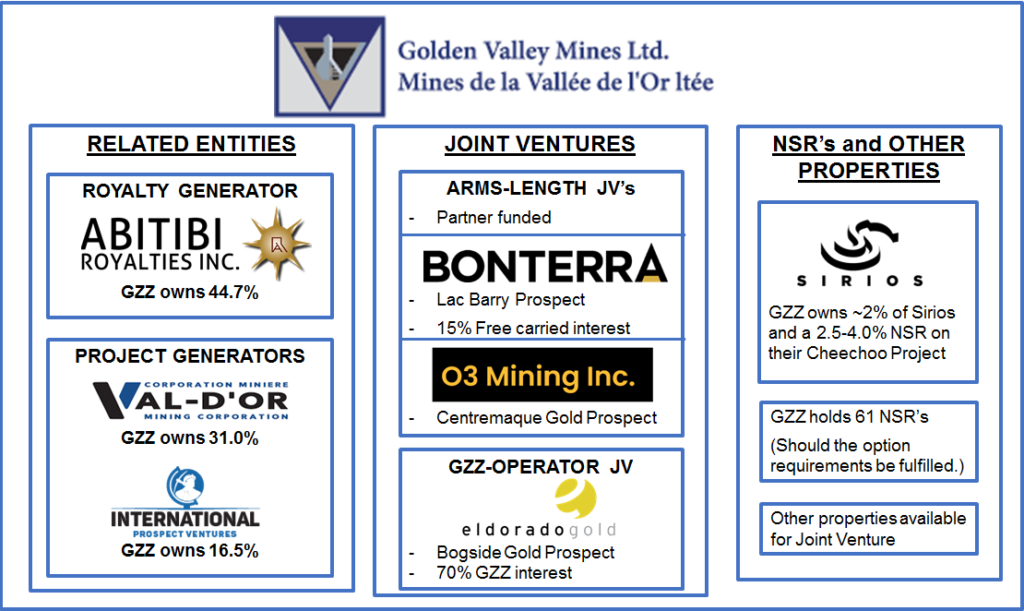

Golden Valley is active in mineral exploration through its: (1) current portfolio of exploration projects and evaluating new project opportunities; (2) partner-funded JV projects; and (3) shareholdings in Related Entity companies.

Through its portfolio of exploration projects, Golden Valley has retained interests in over 18 mining properties, with 61 NSRs on properties optioned to Val-d’Or Mining, and also owns 2% of the shares of Sirios Resources (TSXV:SOI; www.sirios.com) and a 2.5-4.0% NSR on Sirios’ Cheechoo Project.

Golden Valley also has Joint Ventures with Bonterra Resources (TSXV:BTR; btrgold.com) on the Lac Barry Gold Prospect, O3 Mining (TSXV:OIII; www.o3mining.ca) on the Centremaque Gold Prospect, and is the operator with Eldorado Gold (TSX:ELD; eldoradogold.com) on the Bogside Gold Prospect and eight other grassroots projects in Quebec and Ontario.

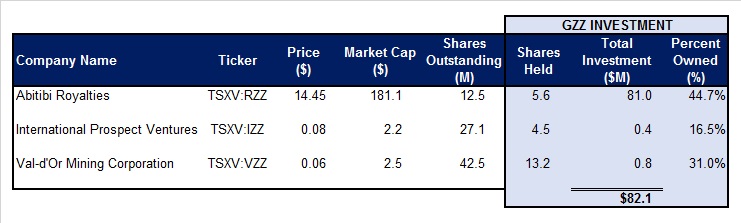

Golden Valley’s Related Entity ownership includes a 44.7% controlling stake in Abitibi Royalties (TSXV:RZZ), a mining royalty company, and ownership in two companies that focus on Project Generation: Val-d’Or Mining (TSXV:VZZ), a 31.0% ownership, and International Prospect Ventures (TSXV:IZZ), a 16.5% ownership.

Key Valuation Driver:

When a Project Generator options a property to a Partner, Partner Agreements often include upfront payments of cash and/or shares as well as annual cash and/or share payments from a Partner. If the Project Generator does not need to sell the Partner shares to fund operations, the Project Generator can build a portfolio of equity holdings.

As of Nov 29, 2019, Golden Valley had an equity portfolio worth over $82 million and a Market Cap of only $50.4 million. In addition, Golden Valley has approximately 63 royalties, 18 properties available for option, and 3 optioned properties at this time. With the equity portfolio worth $83.0 million, and adding the royalties and other properties, the intrinsic value of Golden Valley is worth more than the current Market Cap.

Figure 1: Golden Valley – Portfolio Holdings

Related Entities:

- Abitibi Royalties (TSXV:RZZ)

- Abitibi Royalties is a mining royalty company.

- Golden Valley owns a 44.7% controlling stake in Abitibi Royalties and consolidates its financials into Golden Valley’s financial statements.

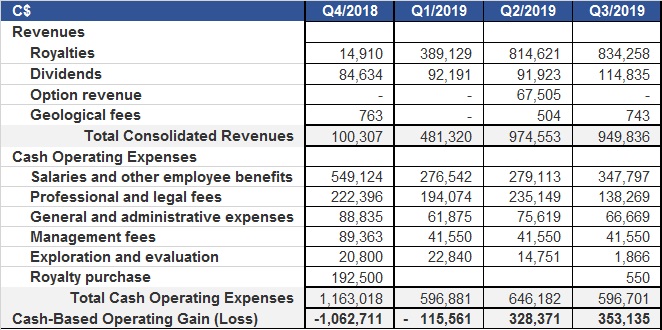

- Abitibi Royalties’ main royalty is the 3% NSR on the eastern portion of the Canadian Malartic mine, owned and operated by Agnico Eagle (NYSE:AEM) and Yamana Gold (TSX:YRI).

- In Q3/2019, royalties generated were over $0.8 million.

- Abitibi Royalties anticipates an updated resource estimate for areas covered by its NSRs at the Canadian Malartic mine in H1/2020.

- Val-d’Or Mining (TSXV:VZZ)

- Val-d’Or Mining is a Project Generation company formed when Val-d’Or optioned 61 exploration properties in the Abitibi Greenstone Belt of N/E Ontario & N/W Quebec from Golden Valley, in return for shares, annual exploration expenditures, and NSRs on all 61 properties.

- Golden Valley holds a 31.0% ownership in Val-d’Or Mining.

- International Prospect Ventures (TSXV:IZZ)

- IZZ is a Project Generation company with eight properties in Western Australia, southeast of Karratha, covering a total area of approximately 1026.10 sq. km., and the Porcupine Miracle Gold Prospect, near Timmins, Ontario.

- Golden Valley owns a 16.5% stake in IZZ.

- Prospecting activities on the Australian properties from March to August 2019 resulted in the discovery and recovery of multiple gold nuggets at or near the surface from seven prospecting programs.

Figure 2: Golden Valley – Summary of Quarterly Financials

Joint Ventures:

- Bonterra Resources (TSXV:BTR)

- Bonterra has earned-in an 85% interest in Lac Barry Gold Prospect, near Val-d’Or, Quebec.

- Exploration is JV Partner funded and Golden Valley has a 15% free-carried interest, and a 3% NSR with a 1% NSR buyback at $1 million.

- Eldorado Gold (TSX:ELD)

- Golden Valley is the operator of the Eldorado JV, consisting of nine properties (8 gold and 1 copper-zinc-silver), with JV partner Eldorado Gold (TSX:ELD) who owns a 30% interest.

- The Bogside Gold Prospect is one of the nine properties.

- O3 Mining (TSXV:OIII)

- In 2017, O3 Mining (formerly Alexandria Minerals) signed a four-year option agreement and can earn an 80% interest in the Centremaque Gold Prospect, near Val-d’Or, Quebec.

- Exploration is JV Partner funded and, when vested, Golden Valley will have a free-carried interest and an NSR.

Figure 3: Golden Valley – Related Entities and Joint Ventures

//

Golden Valley was one of the companies featured in eResearch’s 70-page Project Generator Industry Report. You can download the full, 70-page Project Generator Industry Report by clicking on the following link: eR-IR-ProjectGenerators_2019-09-27_FINAL

//