Written by: Jay Yi, MBA; Edited by: Chris Thompson, CFA, MBA, P.Eng

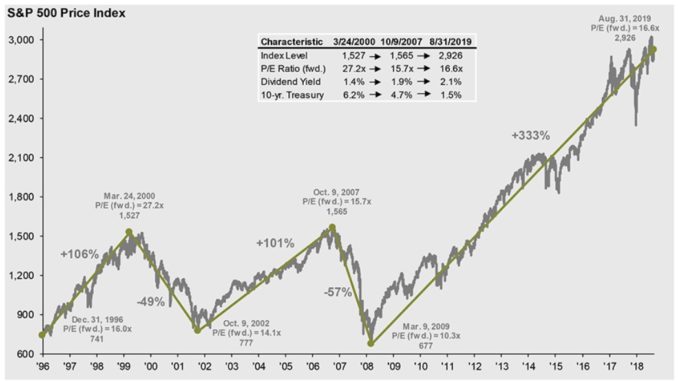

eResearch | The North American stock markets have been on the longest bull run in history but concerns are growing over changes in monetary policy, increasing debt levels, and a potential recession, which is categorized by a decline in economic activity that includes a decrease in consumer spending, reduced corporate expansion, and high unemployment.

Companies that suffer the most in a recession are companies whose products and services are elastic to demand or need consistent financing to sustain growth. An example of an industry that is elastic to demand is the manufacturing and retail industries. An example of an industry that needs financing to operate is the infrastructure and development industry as each new build requires large capital outlays.

Investors and financers are less likely to fund non-defensive companies during recessions mainly because they have high betas, which is a measure of statistical volatility in which a beta higher than 1 indicates a company’s stock price will move in greater volatility in relation to the overall market’s movement. Start-ups and companies that have yet to reach a mature competitive landscape within their respective industry usually have betas that are higher than 1 as these companies accumulate large amounts of losses, invest heavily in growth through marketing and R&D expenses, and do not yet have a predictable consumer base or revenue stream.

Therefore, to prepare for a potential recession in the near future, investors should start focusing on defensive stocks that are inelastic to demand with products and services that are considered a necessity to consumers and will have little to no change in purchasing patterns during an economic downturn. Some defensive stocks that provide discounted products may even have increased demand during recessions due to individuals that usually buy premium products adapting to financially stringent times. Common defensive industries include the utility, food, and healthcare industries, as these are products and services that are basic necessities to living.

Below are some defensive stocks that performed well during the recession in 2007-2009:

A daily necessity is groceries, and Walmart Inc. (NYSE: WMT) is the top discount grocery chain in the world, which consumers will turn to during a recession instead of premium foot outlets such as Wholefoods. In 2008, during the last recession Walmart’s stock price increased by 20%, outperforming the S&P 500 by 58%. The grocery chain has recently moved its business model to an e-commerce retailer from pure brick-and-mortar, which will provide better economies of scale and increased profits moving forward. Walmart currently has a beta of 0.65.

A daily necessity is groceries, and Walmart Inc. (NYSE: WMT) is the top discount grocery chain in the world, which consumers will turn to during a recession instead of premium foot outlets such as Wholefoods. In 2008, during the last recession Walmart’s stock price increased by 20%, outperforming the S&P 500 by 58%. The grocery chain has recently moved its business model to an e-commerce retailer from pure brick-and-mortar, which will provide better economies of scale and increased profits moving forward. Walmart currently has a beta of 0.65.

New clothing is always needed which is why Ross Stores, Inc. (NASDAQ: ROST), a U.S. discount clothing retailer, is a great defensive stock as premium clothing is discretionary and during a recession, consumers are increasingly conscious about spending money on expensive clothing that is not a direct need to their day to day lives. In 2008, during the last recession Ross’s stock price increased by 18%, outperforming the S&P by 56.1%, as higher demand for affordable clothing pushed store expansions from 890 to 956 stores. Ross currently has a beta of 0.82.

New clothing is always needed which is why Ross Stores, Inc. (NASDAQ: ROST), a U.S. discount clothing retailer, is a great defensive stock as premium clothing is discretionary and during a recession, consumers are increasingly conscious about spending money on expensive clothing that is not a direct need to their day to day lives. In 2008, during the last recession Ross’s stock price increased by 18%, outperforming the S&P by 56.1%, as higher demand for affordable clothing pushed store expansions from 890 to 956 stores. Ross currently has a beta of 0.82.

Aside from groceries and clothing, household consumables such as cleaning supplies and toiletry are day to day necessities, which is why Dollar Tree Stores, Inc. (NASDAQ: DLTR), an U.S. variety store chain in which every item cost US$1 or less is another defensive stock to watch. In 2008, during the last recession, Dollar Tree’s stock price increase by 60.8%, outperforming the S&P 500 by 99%. Dollar Tree currently has a beta of 0.64.

Aside from groceries and clothing, household consumables such as cleaning supplies and toiletry are day to day necessities, which is why Dollar Tree Stores, Inc. (NASDAQ: DLTR), an U.S. variety store chain in which every item cost US$1 or less is another defensive stock to watch. In 2008, during the last recession, Dollar Tree’s stock price increase by 60.8%, outperforming the S&P 500 by 99%. Dollar Tree currently has a beta of 0.64.

The companies above did well during the 2007-2009 recession not just because they were defensive companies but also because they were companies that focused on discount priced products which had an opposite effect on demand from recessions. It will be interesting to see how these companies fare in the next recession.

//

Walmart Inc. (NYSE: WMT)

- Headquartered in Arkansas, U.S., Walmart is a multinational retail corporation that operates discount department and grocery stores through 11,389 locations in 27 countries, operating under 55 different names.

- Walmart is currently trading at US$114.73 per share with a market capitalization of US$327.5 billion.

Ross Stores, Inc. (NASDAQ: ROST)

- Headquartered in California, U.S., Ross operates under the brand name Ross Dress for Less and is an American chain of discount department stores with 1,483 locations in 37 U.S. states.

- Ross is currently trading at US$109.18 per share with a market capitalization of US$39.8 billion.

Dollar Tree Stores, Inc. (NASDAQ: DLTR)

- Headquartered in Virginia, U.S., Dollar Tree, formally known as Only $1.00 and Everything’s a Dollar, is an American chain of discount variety stores that sell products at a maximum of $1 and operates 14,835 stores in 48 U.S. states and Canada.

- Dollar Tree currently trades at US$109.62 with a market capitalization of US$25.9 billion.

//