eResearch attended an investor presentation earlier this week by a U.S. REIT included in the “Net Lease” sector. The Company claims to be the only one of its kind that is publicly-traded.

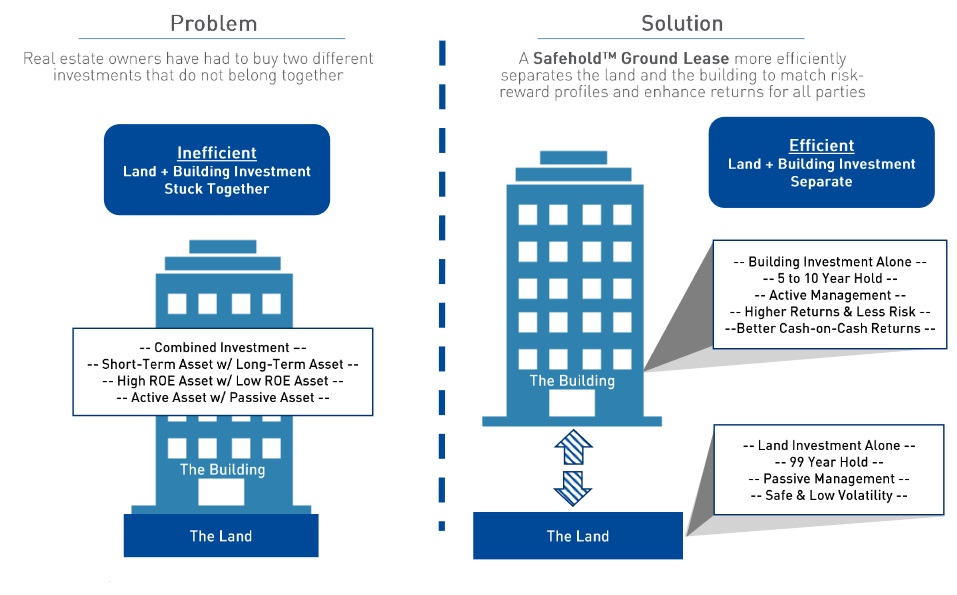

Safehold Inc. (NYSE: SAFE) is a “ground lessor”. The Company offers a real estate owner or developer an opportunity to enter into a ground lease, i.e., the owner/developer rents rather than owns the land, thereby providing a more efficient use of capital relative to fee simple ownership where the owner/developer owns both the land and the building.

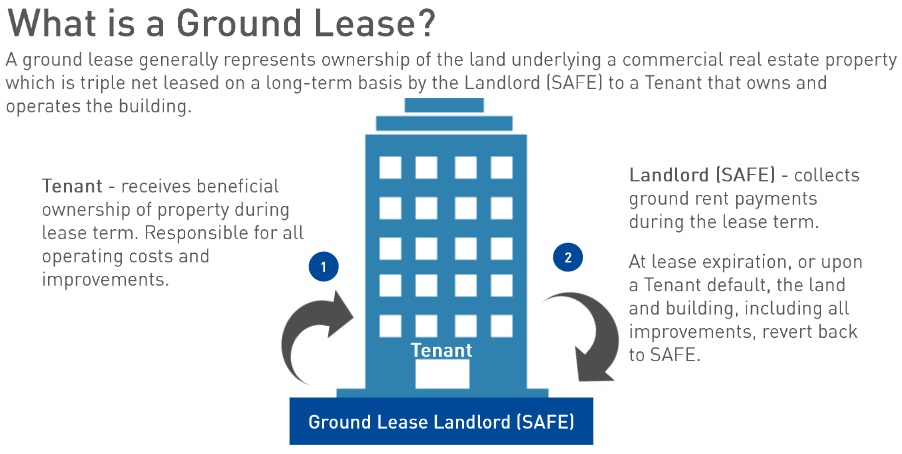

A ground lease involves the renting of land that is either improved or unimproved for an extended period, usually 50-99 years. The ground lessee, or tenant, pays the ground lessor, or land-owner, a rent for the use of the land on which the tenant owns the improvements that either exist or are constructed. The land and improvements thereon revert to the land-owner at the end of the lease term. During the ground lease term, the tenant is responsible for all operating costs and capital expenditures associated with the building; thus, it is a triple net lease to the land-owner.

During its existence, the ground lease occupies the senior 30%-40% of the capital structure and it also is senior in rent payment priority. If the ground lessee (building owner) defaults on the ground rent, then the ground lessor (Safehold) takes over the building to do with as it wishes. If the ground lessee defaults on its building mortgage, the mortgage lender (usually a bank or mortgage company) takes over the building and becomes responsible for paying the ground rent. Either way, the ground lessor does not lose.

During its existence, the ground lease occupies the senior 30%-40% of the capital structure and it also is senior in rent payment priority. If the ground lessee (building owner) defaults on the ground rent, then the ground lessor (Safehold) takes over the building to do with as it wishes. If the ground lessee defaults on its building mortgage, the mortgage lender (usually a bank or mortgage company) takes over the building and becomes responsible for paying the ground rent. Either way, the ground lessor does not lose.

Safehold’s ground lease investments provide excellent risk-adjusted returns with built-in inflation protection through its annual rent escalators that compound over the entire term of the ground lease.

Safehold targets the institutional U.S. commercial real estate market that is estimated to be worth approximately $7 trillion. The Company confines itself to being active in the 25 largest metropolitan areas in the USA.

Our report is provided for information purposes only. It is not a recommendation to either purchase or sell the shares of the Company.

You can download our information-only report by clicking on the following link: … SAFE_082919-Perspective